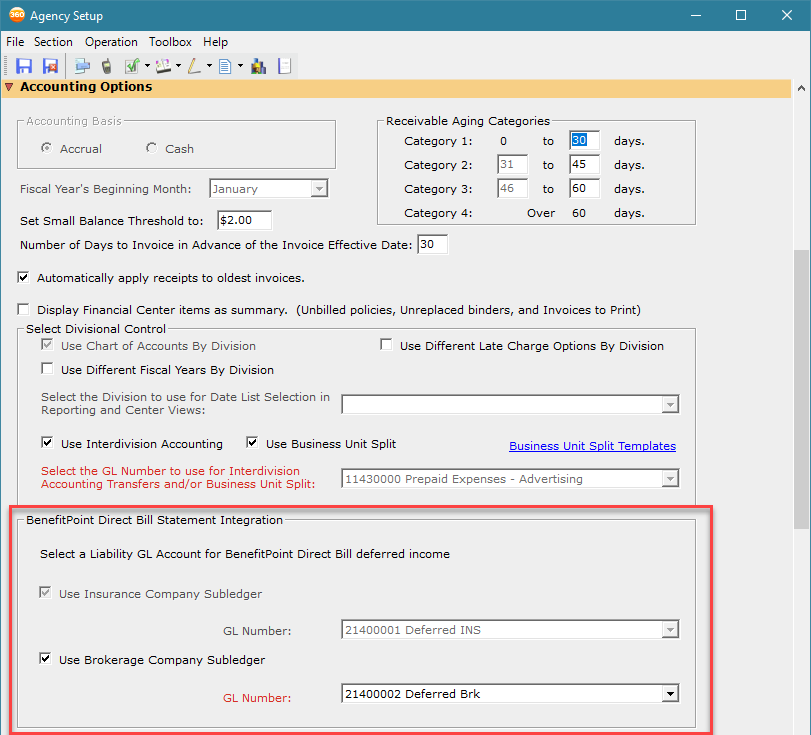

Agency Setup - Accounting Options

You can set default accounting options that apply to the agency.

To set accounting options:

- Open the Agency Setup form as described in Agency Setup.

- Expand the Accounting Options section, and then enter the following information.

Accounting Basis | Select whether your agency accounting basis is Cash or Accrual. For additional information, see Choosing the Cash or Accrual Accounting Method. Vertafore also recommends that you consult your agency accountant. AMS360 defaults to Accrual basis accounting.

| ||||||

Receivable Aging Categories | Aging categories are the number of days old "buckets" for reporting your receivables open balances. Set up the day range categories most useful to your agency. For example:, (0-15), (16-30), (31-45), (Over 45). Fill in Category 1-3 as appropriate for your agency.

| ||||||

Fiscal Year's Beginning Month | Select the first month of your agency's fiscal year from the list. For example, if the agency is on a calendar year, select January. Check with your agency's accountant if unsure.

| ||||||

Set Small Balance Threshold to | The dollar amount entered represents the maximum invoice balance, which employees with appropriate security, can write off through the Receipt process. | ||||||

Number of Days to Invoice in Advance of the Invoice Effective Date: | This number specifies when the system generates and posts Customer Center Billed (Agency and Direct) invoice transactions, in advance of their effective dates. This allows you to print, send, and/or collect these premiums in a timely fashion. This value can be set to any number the agency chooses. Common choices to bill in advance are 30 or 45 days. Example: Set the number of days to bill in advance to 30. Based on the current system date, when Daily Process is run, any invoice with an effective date equal to or less than 30 days in the future will post and print. Any invoice more than 30 days in the future will not. For the occasional invoice that requires posting and printing more than the number of days to bill in advance, such as certain types of bonds, use the Post Future Invoice option. | ||||||

Automatically apply receipts to oldest invoices | Allocates an Amount entered into the Receipt Information section of the Receipts form automatically in the Insured (or Broker) Accounts Receivable grid based on the oldest Invoice Date. If this option is active, tabbing out of the Amount field applies the payment amount to the Invoice Balance with the earliest Invoice Date. Amounts matching Invoice Balances are applied until the receipt amount is exhausted.

Example: Option is Active (checked in Agency Setup) On tabbing out of the Amount field, $1000 was applied to Inv Date 1/11/05. Remaining $9,000 was applied to next oldest invoice (Inv Date 2/4/05).

Default setting (Automatically apply option is unchecked) In this example, tabbing out of the Receipt Information Amount field caused no automatic distribution. The user then clicked the AutoFill box on Invoice #22, Inv Date 2/4/05, to match the invoice identified by the customer with payment.

| ||||||

Display Financial Center items as summary | If this option is selected, certain Financial Center summary items (Unbilled Policies, Unreplaced Binders and Invoices to Print) display either Yes (such items exist) or No (none exist). The option defaults as checked.

| ||||||

Divisional Control | When agencies merge or form cluster alliances, the ability to maintain different Charts of Accounts and/or Fiscal Year Ends for each entity can be important. Use the Divisional Control group in this section to activate these features. You cannot alter fiscal year ends for an existing Division. When a new division is added with a different Chart of Accounts you can remove authorization for existing Divisions to use a particular GL account, if desired. See Chart of Accounts Setup for more details. The following options are available in the Divisional Control group:

Select the Division to use for Date List Selection in Reporting and Center Views: Choose the division to display in all Center Views. Division Beginning Month (in the Business Unit Setup form): This field allows you to assign a different beginning month than the Fiscal Year's Beginning Month as entered in the Agency Setup - Accounting Options section. To use this option do the following: In Agency Setup

In Business Unit Setup Select the appropriate fiscal year beginning month from the Division Beginning Month list.

| ||||||

| BenefitPoint Statement Integration | For agencies that currently use the BenefitPoint integration, they are now able to set up and select a GL account of their choice that will be used exclusively for deferred revenue created by direct-bill invoicing for a future-dated policy from BenefitPoint.

SETUP

| ||||||

Late Charge Options | The system assesses late charges during Daily Process on the last day of the fiscal period. The default option is Do Not Generate Late Charges. The available options are as follows:

| ||||||

Binder Post Method | This option determines when a binder invoice posts to the general ledger, payables, income and expenses. Invoices will not pull to account current and/or commission statements until the binder policy transaction has been replaced, regardless of the binder post method selected. The available options are as follows:

| ||||||

Commission Parameter Ranking | This option allows you to identify how you want to rank Agency and Employee/Broker (Production) commissions. The rankings determine which rate the system uses if an agency or direct bill invoice matches on more than one commission parameter. Agency commissions must be entered by writing company therefore Writing Company is, by default, ranked #1 and cannot be changed. The same goes for Division / Branch, which will always be ranked #2. The other categories in the Agency commissions group can be ranked as desired. The parameters in the Employee/Broker group can be ranked in any order you desire. Example: Set up rankings for Company A to:

As part of Company Setup, you then enter commission rates of:

When you enter New Business for a Burglary policy, the system finds a match on Burglary (10%) and on New Business (12%). Since you ranked Line of Business higher than Transaction, the 10% rate would be used. | ||||||

Pay Employees Net (After Broker Commission) | When this box is checked and you make a new policy, the Employees Paid Net box is checked in the Additional Policy Information section. This box can be unchecked on an unbilled policy. | ||||||

| Producer Payable and Expense Allocation for Broker Business | This gives you the option to track the producer expense along with your agency expense, payable accounts, or with your broker expense accounts. You have two options to select from:

|

What's Next?

Do you want to enter additional information in the Agency Setup form? See Agency Setup for more information.