AMS360 2019 R1 Release Notes

We are pleased to release AMS360 2019 R1. With each release, we are improving and updating AMS360 to provide you with the best possible experience.

To print this topic in its entirety, in the upper-right corner of this Help page, click Expand all , and then click Print

, and then click Print .

.

Required

Minimum workstation requirements as shown in the AMS360 2018 R1 Online Configuration Guide (Doc ID:14400) on My Vertafore. You must be registered with My Vertafore and signed in to access this document.

Supported

Browser

- Microsoft Internet Explorer 11 (32-bit) with default settings

- Microsoft Edge

- Google Chrome

Operating Systems

- Microsoft Windows 7 (32-bit and 64-bit)

- Microsoft Windows 8.1 (32-bit and 64-bit)

- Microsoft Windows 10 (32-bit and 64-bit)

Microsoft Office

- Office 2013

- Office 2016

.Net

- .NET 4.7 (required)

For more information about AMS360 recommended and supported configurations, see the Supported Configurations Matrix (Doc ID: 12604) on My Vertafore. You must be registered with My Vertafore and signed in to access this document.

Microsoft Office

- Office 365 (32-bit)

- We only support Microsoft Word, Excel, and Outlook locally.

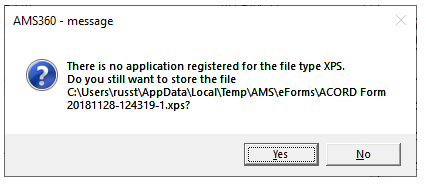

XPS message

Microsoft has changed the way that they are giving customers the XPS viewer which is used for some functionality in eForms manager.

Depending on the build number of the OS that you have, you may need to install the new viewer. Click here for more details.

-

You will receive the following error message when the system is logging an activity using print functionality vs. fax or email.

AMS360 Message

We value your feedback to ensure we are working on what is most important to you. If you have an idea to improve the product, you can suggest and vote on product enhancement requests on Vertafore Ideas. On My Vertafore, click Submit Idea in the upper right corner of the page. We appreciate your input to help us provide you with the highest quality product.

For more information on using Ideas, please see the following documents. You must be registered with My Vertafore and signed in to access these documents.

• Ideas Overview (Doc ID: 13054)

• How to Submit Ideas (Doc ID: 13049)

• What are the statuses in Vertafore Ideas? (Doc ID: 13055)

What's New

Before

You could only append descriptions to activities, not attachments.

Now

You can now append new attachments to existing Activities. You will no longer have to create additional activities to log appended descriptions.

Attachments Include:

-

Files

-

Emails

-

Doc 360 Files

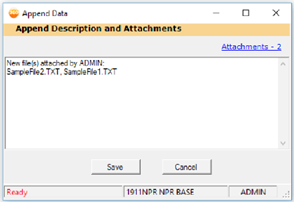

Append Data

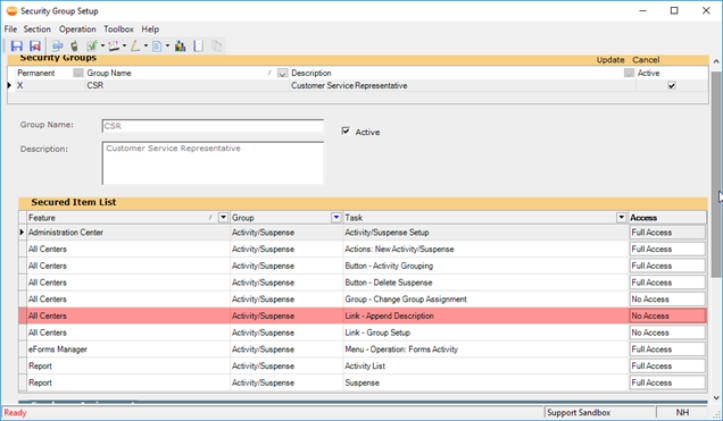

HOW TO GRANT ACCESS TO APPEND ACTIVITY

Security access to AMS360 will need to be modified for all users needing access to Append Data within AMS360 Activities. Permanent Security Group “Owner” is the only Security Group that defaults to allow this option with upgrade.

Users will need to be given access to the below Security Group setting in AMS360 in order to access the link to append.

-

Feature: All Centers

-

Group: Activity/Suspense

-

Task: Link-Append Description

-

Access: Full Access

Security Group Setup

|

Note: If agency users are only part of a permanent Security Group in AMS360 that cannot be modified, the group will need to be copied into a non-permanent group before access can be modified. Please contact support for assistance setting up new Security Groups. |

-

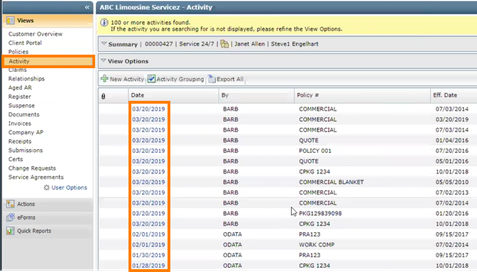

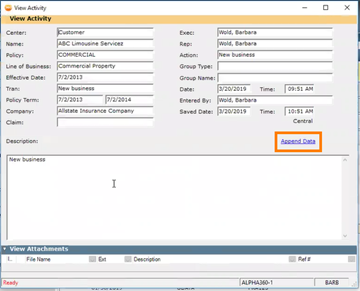

In the Customer center, select a specific Customer, and click the Activity view.

Select an Activity

-

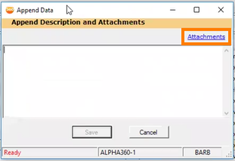

In the View Activity winform, click Append Data. Then in the Append Data winform click Attachments.

Append Data

Attachments

-

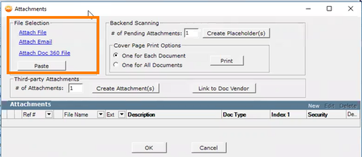

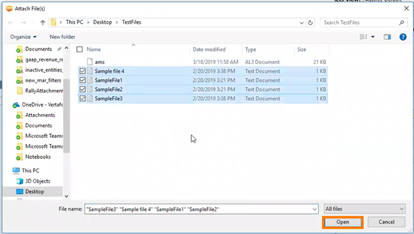

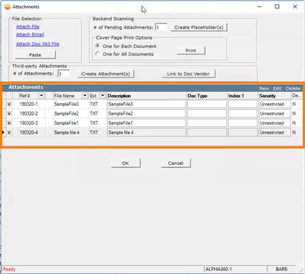

In the Attachments winform, you will be able to attach files from your files system, emails, and Doc 360 files. To start, click Attach File. From here, attach files that are stored on your computer and click Open.

Attach File

Attaching Files

-

You will see your files attached on the Attachments winform.

Files Attached

-

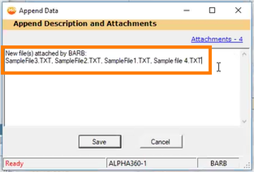

Click OK on the Attachments winform. You will be brought back to the Append Data winform and will now see your new attachments and their description. You will also be able to see how many attachments are included in the top-right corner.

Append Data: New Attachments

|

-

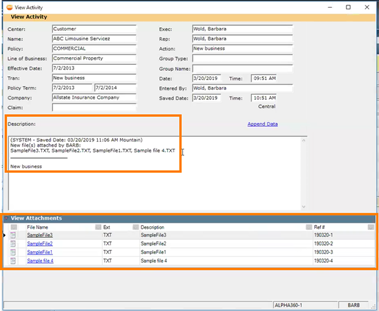

After clicking Save, you will see your new description and attachments on the original Activity winform.

View Activity: View Attachments

NEW Y/N COLUMN TO INDICATE IF ACTIVITY HAS APPENDED DATA

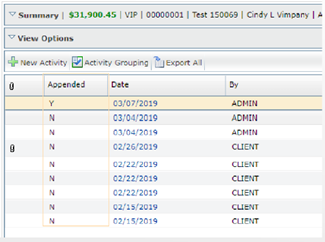

A new column is available to indicate if an activity has appended data. You will now be able to scan for activities with appended data.

|

Note: This column has also been added to the details panel in the Policies view. It will be a hidden column by default. |

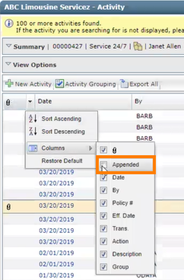

Appended Column

To Access this Column:

-

In the Customer center, select a specific Customer, and click the Activity view.

-

Click the drop-down next to the paper clip column, hover over Columns, and click the Appended checkbox.

View Appended Columns

-

You will see either a Y or N depending on if an activity has appended data.

Appended Column

Before

When holders are copied from one certificate to another, their attachments are not copied.

Now

You have the choice to copy a holder’s attachments when copying a holder from one certificate to another. You now won’t have to manually copy attachments between holders when copying a certificate.

|

Note: This functionality is also available when adding/editing holders on an existing certificate and updating a certificate. |

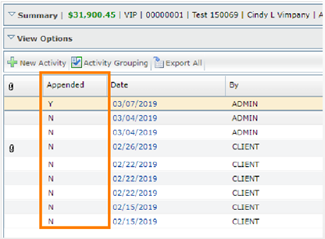

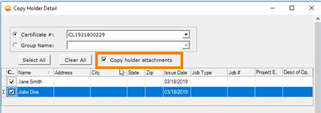

Copy Holder Attachments

How To Copy Holder Attachments

-

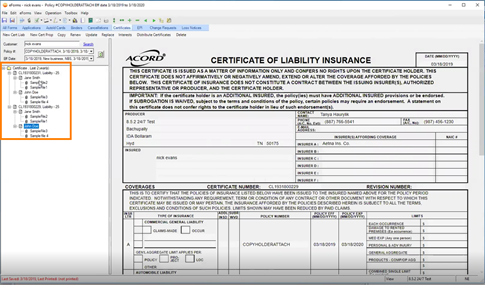

In the Customer center, navigate to an existing Certificate of Liability that is attached to a policy.

-

Here you can either add or copy holder attachments.

-

Certificate of Liability: Holder Attachments

-

Right-click on the holder attachments and click Renew.

Holder Attachments: Renew

-

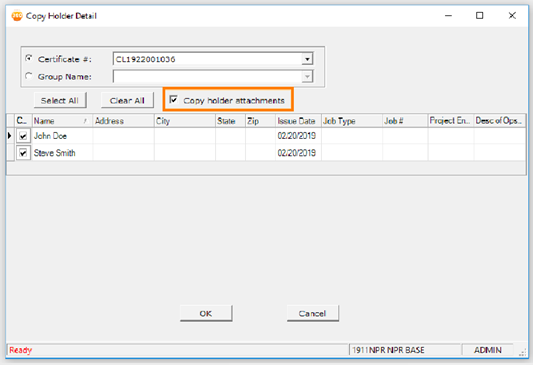

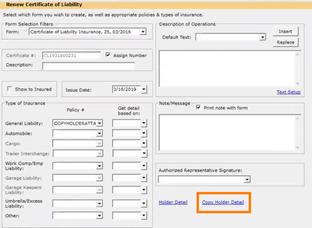

In the Renew Certificate of Liability winform, click Copy Holder Detail.

Copy Holder Detail

-

The Copy Holder Detail winform will open. Here you will have the new option to Copy Holder Attachments.

-

Select the Certificate # and the holder attachments you want to copy by checking the box next to the attachments and click the checkbox next to Copy Holder Attachments. You will be able to see your copied holder attachments when reviewing your policy.

Copy Holder Attachments

Added Holder Attachments

Before

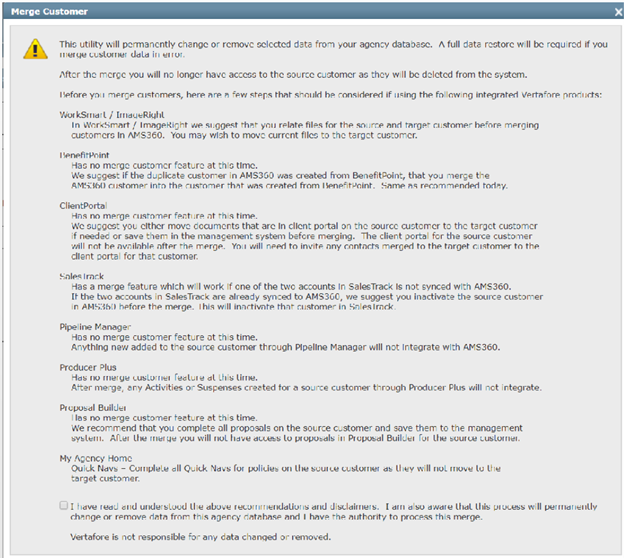

Prior to merging, Merge Customer had a disclaimer with limited details about how the merge process will impact integration products such as Insurlink.

Now

The AMS360 disclaimer will now have more details about what customers can expect for our integration partners when they merge a customer in AMS360. This will give you a better idea on the impact and processes that take place when a customer is merged, which will better align the data they have in other products with what exists in AMS360.

Merge Customer: Disclaimer

Before

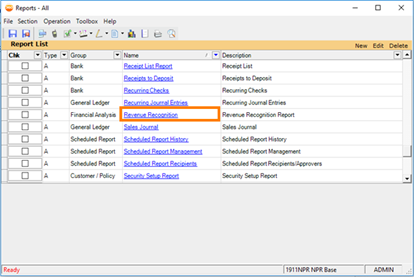

A Revenue Recognition report did not exist prior to this release.

Now

A new Excel report is available through the AMS360 classic reports menu.

-

Currently this report is not featured in My Agency Reports.

Due to regulation stemming from ASC 606, Revenue from Contracts with Customers, Vertafore has created a new accounting feature to help you keep track of recognized revenue as it’s earned through the transfer of promised goods or services to customers.

Starting January 1, 2019, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) will require privately held agencies to keep track of recognized revenue.

For public organizations, the new requirement regarding revenue recognition is effective for any annual reporting periods that begin after December 15, 2017.

For all non-public and not-for-profit organizations, the new requirement regarding revenue recognition is effective for any annual reporting periods that begin after December 15, 2018.

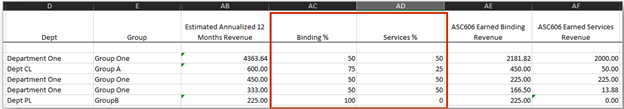

In the 19R1 AMS360 release, you will be able to generate a new Revenue Recognition report that details billed invoices against policies and how much money has been recognized versus earned against policies.

-

You will be able to designate a 12-month window to report on.

-

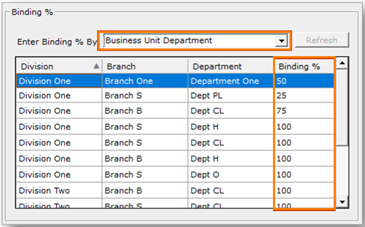

You will be able to designate different binding % and services % revenue breakdown by various properties (business unit and line of business).

-

The report will generate as an Excel file, and the formulas used to calculate recognized and earned revenue will be viewable within the cells.

-

The report will consider both agency and direct bill scenarios, taking into account the agency commission % and agency fees in billed revenue data points.

-

The Excel report will be locked down to protect the integrity of the data.

HOW TO USE REVENUE RECOGNITION

-

Click Toolbox in the bottom-left hand corner of your screen, then click Classic Reports.

-

You will be redirected to the Reports - All winform. Scroll down and click Revenue Recognition.

Reports: Revenue Recognition

-

You will now be redirected to the Revenue Recognition report winform.

Revenue Recognition Report

-

Here you can choose to set a range of criteria to include in your report, including:

-

Bill Method: Agency or Direct Bill

-

Type of Business: Personal, Commercial, etc.

-

Lines of Business: All Lines of Business associated with the type of business selected (ex. Type = personal, LOB = personal passenger auto) are available to select.

-

Business Unit: You can filter business units that you have access to. Business unit splits will display on the report as separate line items under the same policy.

-

The default value for all four lines is All.

-

-

Here you can choose to set a range of criteria to include in your report, including:

-

Bill Method: Agency or Direct Bill

-

Type of Business: Personal, Commercial, etc.

-

Lines of Business: All Lines of Business associated with the type of business selected (ex. Type = personal, LOB = personal passenger auto) are available to select.

-

Business Unit: You can filter business units that you have access to. Business unit splits will display on the report as separate line items under the same policy.

-

The default value for all four lines is All.

-

Binding %

-

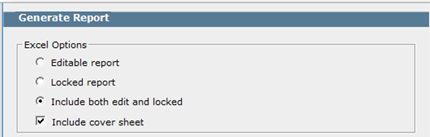

Excel Options:

-

Cover Sheet: This will display an Excel sheet listing the user’s selections/filter criteria.

-

Editable Report: This will allow you to make any changes you wish to the Excel sheet.

-

Locked Report: This option will make it so you cannot make any updates or formatting changes to the Excel sheet.

-

Excel Options

-

Once you finish entering the criteria you wish to have included in your report, click Generate.

-

You will have data for the 11 months prior to the month you select for the report.

-

Example: If you select January 2019 as the end date, the report will pull polices that have an in-force date or are invoiced between February 2018-January 2019

-

Generate Report

-

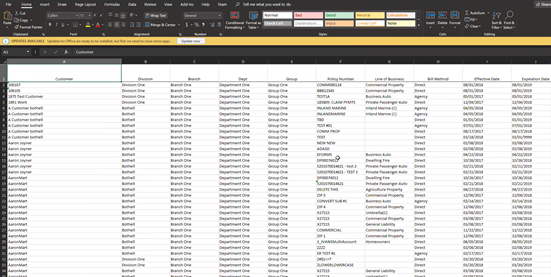

Your report will now be exported to Excel for you to view.

Excel Report

Your Report will Include:

Columns

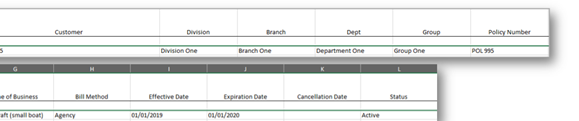

- The First 12 Columns display policy specific information (from the Policy winform)

- Included are:

- Customer Name

- Policy Business Unit

- Policy #

- LOB

- Bill Method

- Eff/Exp Date

- Cancellation Date

- Policy Status

- Each Policy LOB will have its own line item in the report.

- If a policy contains a business unit split, then each part of the split will result in a separate row in the Excel sheet.

Policy Info

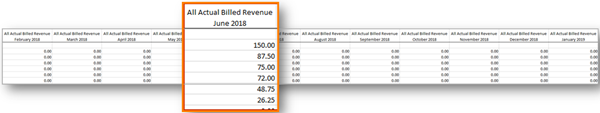

Monthly Billed Revenue

• The report pulls policy revenue data for the trailing twelve months based upon the user entered date.

• The billed revenue dollar amount listed in the report takes into account agency commission percentages of the transaction premium and also agency fees.

Billed Revenue

Total 12 Months Billings - Estimated Contract Value

- The summation of the billed revenue over the last 12 months on a policy.

Estimated Annualized 12 Months Revenue

- This estimates the yearly billed revenue as if there were 12 months of billings. This is valuable for when a policy starts halfway through the reporting period. The Estimated Annualized 12 month’s revenue is an estimate, most accurate when the pay plan is monthly.

Estimated Revenues

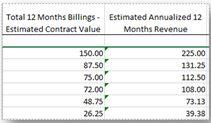

Binding % and Services %

- The Binding % column displays a percentage parameter that is entered by the user in the Report – Revenue Recognition Selections winform prior to report generation.

- The Services % is the percentage of revenue earned by the agency as services are realized by the customer.

- These fields are valuable if the agency wants to differentiate revenue % that is earned at the beginning of the policy duration versus revenue % that is earned as services are provided on a temporal basis over the course of the policy duration.

Binding % and Services %

ASC606 Earned Binding Revenue

This is the estimated earned binding revenue on the current policy, annualized. It is the Estimated Annualized 12 Months Revenue * the Binding %.

ASC606 Earned Services Revenue

This is the estimated earned services revenue on the current policy based on the number of months that services have been delivered on the policy thus far. It is the (Estimated Annualized 12 Months Revenue * Services %) * (Number of months services have been delivered/12).

ASC606 Total Earned Revenue

The is the sum of the earned binding revenue and the earned services revenue. This is the amount of money that has theoretically been EARNED so far on the current policy.

Contract Period Total AMS360 Recognized Revenue

This is the ACTUAL amount of billed revenue against a policy within the report period. This calculation is the sum of all the billed revenue in the report after the policy effective date up to the report date. This number is the concrete dollar amount the agency has recognized via billings.

Unbilled Revenue (Deferred Revenue)

- This column indicates the revenue that the agency has theoretically earned on the contract over the course of a year vs. the amount of money the agency has recognized through billings.

- The report performs this calculation automatically using Excel formulas.

- If the unbilled revenue number is positive, the agency has not yet recognized all revenue on the contract.

- The accuracy of the unbilled revenue number depends on the accuracy of the estimated contract value.

Unbilled Revenue

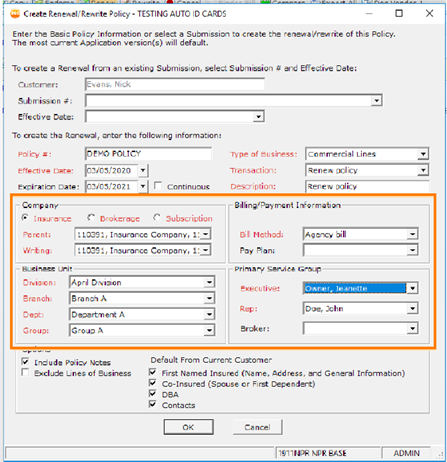

Before

You have been able to renew, rewrite, and copy a policy with inactive companies, employees, brokers and business units.

Now

AMS360 will now protect and prevent a user from renewing, rewriting, or copying a policy with inactive companies, employees, brokers and business units. This will help the agency from introducing an errors and omissions scenario and will improve data quality.

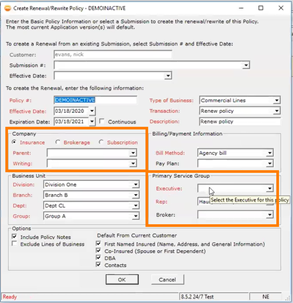

Create Renewal/Rewrite Policy (Active Policy)

UNDERSTANDING THE NEW PREVENTIONS

1. In the Customer center, select a policy to renew. You will notice that we added information on Business Unit and Primary Service Group for you to input data.

2. If you marked an employee, company, primary service group or business unit as Inactive, you will no longer be able to see info for that group, therefore you will not be able to renew/rewrite/copy/submit this policy.

Create Renewal/Rewrite Policy (In Active Policy)

-

You will be forced to select an active executive, broker and rep before renewing, rewriting, or copying a policy.

Before

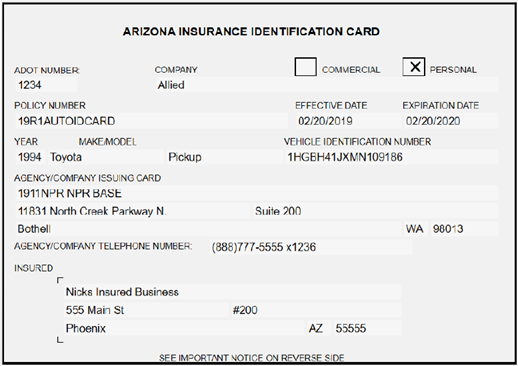

The Arizona ID car is outdated in AMS360 and the mapping rules for the Oklahoma ID card were incorrectly displaying vehicle coverages.

Now

You will have the most current ACORD version of the Arizona ID card in AMS360.

The Oklahoma auto ID card coverages will also have the accurate information displayed.

Arizona Auto ID Card Changes

- The Company NAIC number is now labeled the ADOT number.

- Address fields now displays Address Line 2.

- Vehicle Make and Model now display as two separate fields.

AZ ID

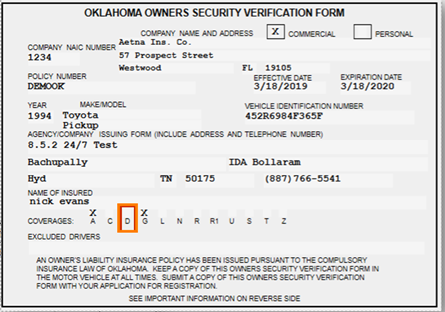

Oklahoma Auto ID Card Changes

- The coverages on the 127 form did not previously map correctly to the OK security verification form.

- Now the OK security verification form will reference the vehicle-specific coverages and not the Line of Business-specific coverages.

OK ID

Before

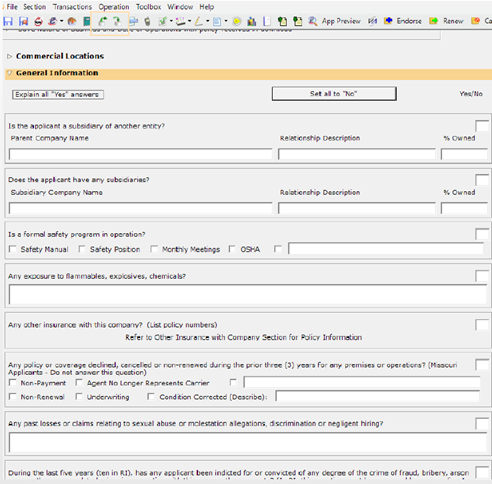

The ACORD 125 General Information section had limited support for import/export.

Now

The entire ACORD 125 General Information section can be exported and imported. You will now have a more robust AL3 integration for the ACORD 125.

General Information

HOW TO EXPORT ACORD 125 INFO

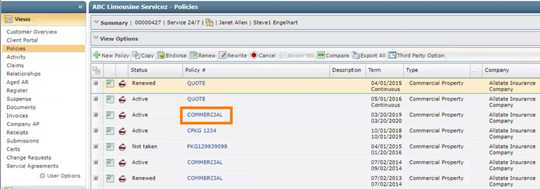

- In the Customer center, select a specific Customer, and click the Policies view.

- Locate the policy that you want to export the General Information from and click it.

Select a Policy

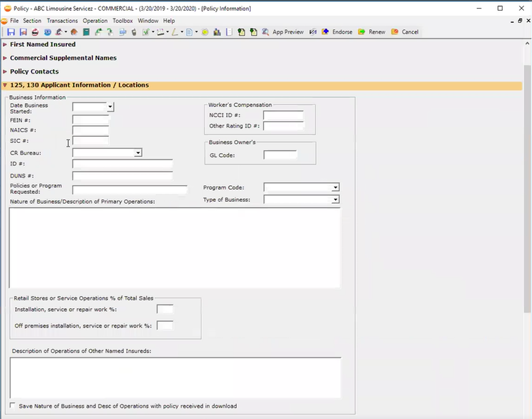

- Scroll down and click the drop-down next to 125, 130 Applicant Information/Locations.

ACORD 125 Info

-

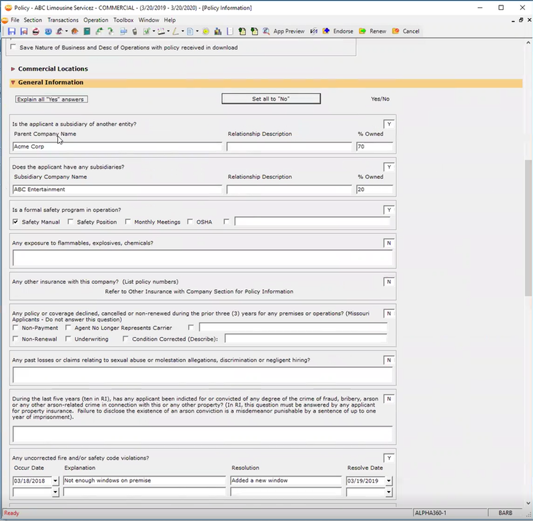

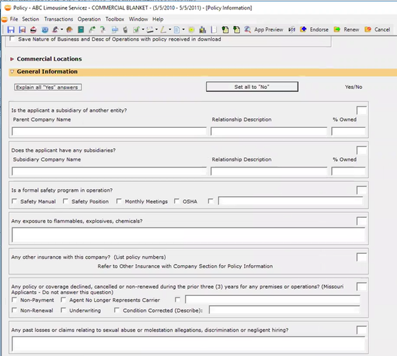

Scroll down and click the drop-down next to General Information. You will notice that this form already has certain information filled in. We will be exporting this info in order to import it into another policy.

ACORD 125: General Information

-

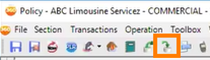

Click the Export button in the tool bar.

Export

-

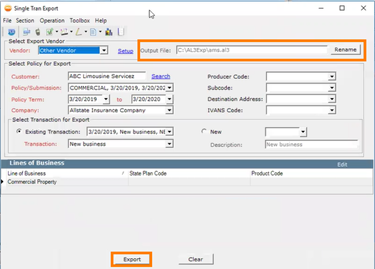

In the Single Tran Export winform, select your Output File where this info will be stored, and then click Export. Your information will be stored to wherever you set the output file.

Output File

HOW TO IMPORT ACORD 125 INFO

-

Find and click a policy that does not have any of the General Information entered for the 125 section. We will be importing the info we just exported previously.

Empty ACORD 125 Info

-

Click the Import button.

Import

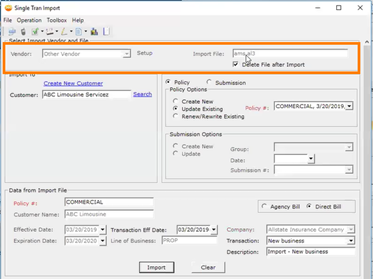

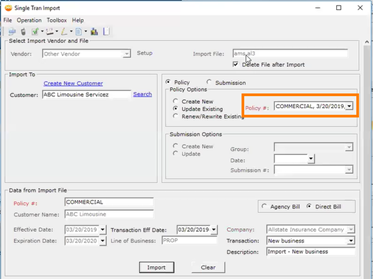

- The Single Tran Import winform will appear. Select your Vendor and Import File.

- De-select Delete File after Import if you want to keep this file for future uses.

Delete File after Import

-

Choose the Policy# you want to import.

Import Info to Policy

-

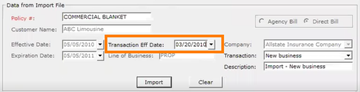

Set the Transaction Eff Date: to a date that is between the Effective Date and Expiration Date.

Transaction Eff Date:

-

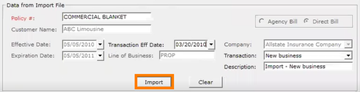

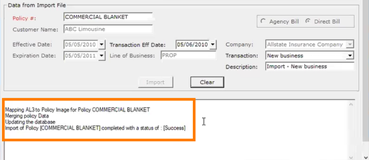

Finally, click Import. If the import was successful, you should be able to see what was imported at the bottom.

Import

Successful Import

Before

The average time to load the Policy winform in a test environment took 11 seconds.

Now

The time to load the Policy winform in a test environment takes 5 seconds, a more than 50% increase in speed.

- Note: Production environment results might vary.

- This feature enhancement will improve the day-to-day efficiency for agency users.

Policy Winform

Before

You had to manually post cash receipts and deposits in AMS360.

Now

This new feature will provide you with the ability to import a .csv file from the bank into AMS360, applying the cash receipts against the insured’s A/R invoices or on account and posting the deposit. This will help you keep pace with new banking process and automation for productivity and accuracy.

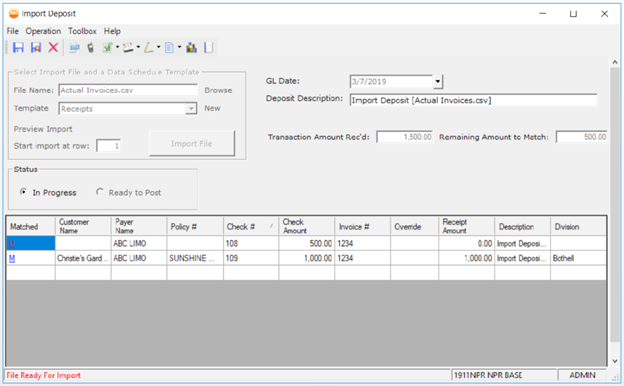

Import Deposit

How To Use the Payment Import

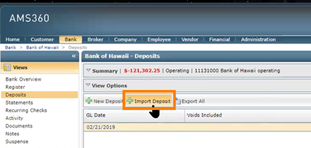

- In the Bank center, select a bank and click Deposits in the Views section. Click Import Deposit to open the Import Deposit winform.

Import Deposit Button

-

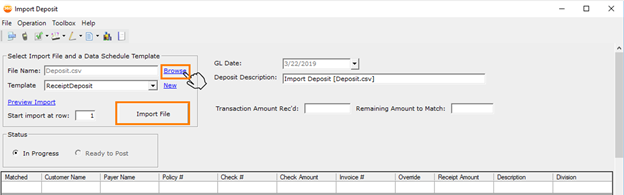

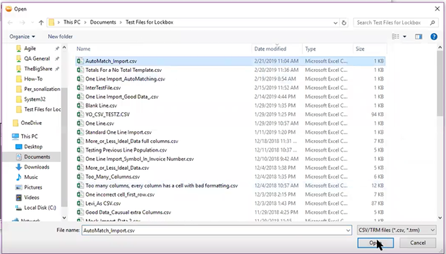

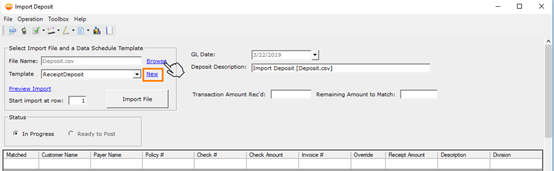

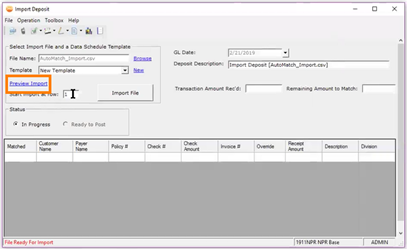

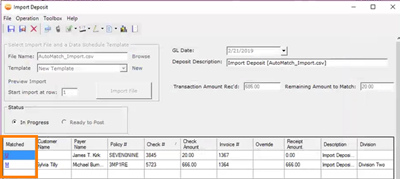

Click Browse so you can select a .csv file of deposits to import. You can configure your import using the Import Deposit screen, and then click Import File.

Import Deposit Form

File Browser

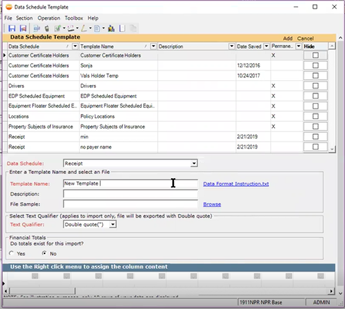

- If you need to create a new template for a new bank or .csv format, click New. Fill in the information you want included in your template. Once finished, save and close the template and you will now see your new template as an option.

New Template

Data Schedule Template

-

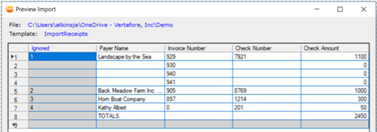

Click Preview Import to see your work. Then click Import File to start the import process.

Preview Import

Preview

-

Receipts with invoice number and amount that matches an AMS360 invoice remaining balance will be auto-matched and will display an M for Matched.

-

Receipts that don’t auto-match will display a U for Unmatched. You will need to click the U to manually apply the receipt.

-

Multi-invoice checks will auto-match if the sum of invoice balances equals the check amount.

-

Receipts are matched based on:

-

Invoice number in bank file matches invoice number in AMS360.

-

The Receipt amount in bank file matches Invoice amount in AMS360.

-

Matched Column

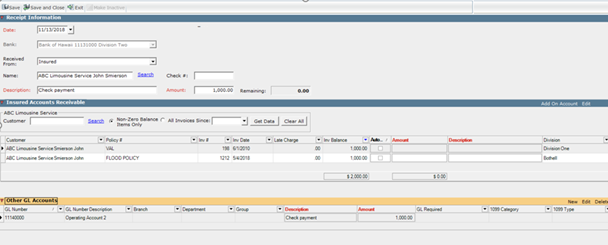

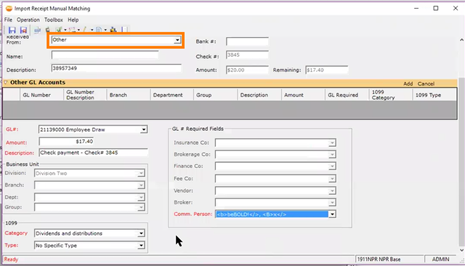

- Click the U in the matched column to display the Manual Receipt form allowing the user to manually match receipts. You will be able to search for the customer and then apply the payment to one or more of the open invoices in the Insured Accounts Receivable by checking the Auto Fill box to apply the payment to that invoice.

-

If no invoices are available, you may apply the payment “On Account.” You can also select Other from the Received From drop-down and then apply the payment directly to other GL accounts in the lower section. Click Save and Close when you are finished.

Manual Matching (Insured Accounts Receivable)

Manual Matching (Other)

-

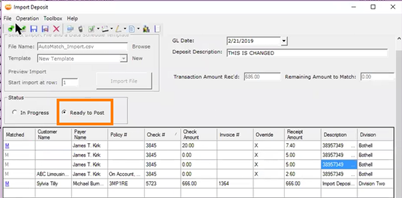

Once all the receipts are matched and the remaining amount is zero, the Ready to Post button becomes available. User will select a GL date and deposit description. The statement can then be posted and saved.

Ready to Post

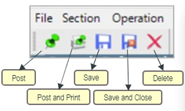

Menu Options

Before

You would have to create policies in order to charge customers for service fees.

Now

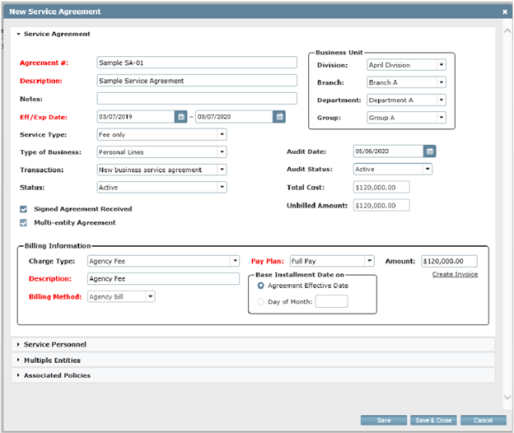

You will have the ability to create a Service Agreement which may be associated with one or many policies, have service personnel commissions and multi-entity billing capability. You may then invoice customers for consulting and other service fees.

You can issue a standard or a multi-entity service agreement depending on your needs.

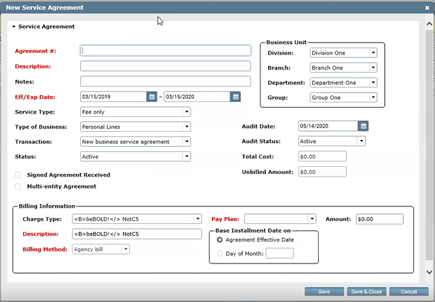

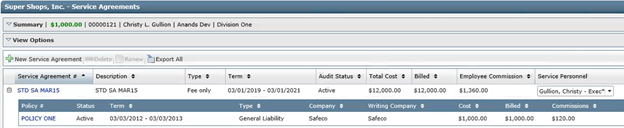

New Service Agreement

Getting Started

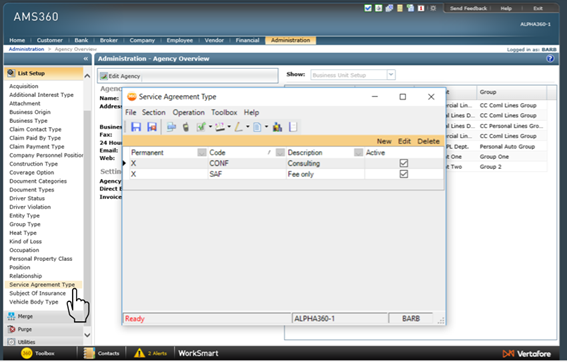

- In the Administration center, click Service Agreement Type under List Setup to either select the default types (consulting and fee only) or add a new type.

Admin Setup

HOW TO SET UP A SERVICE AGREEMENT

- Choose a customer that you would like to set up a service agreement with in the Customer center.

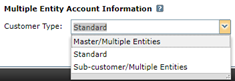

- Check to see if the customer is labeled as Standard or Multiple Entities.

- Click Customer Overview in the Views section.

- Click Edit Customer and scroll down to the Multiple Entity Account Information drop-down. Here you will see if your customer is labeled as Standard or Multiple Entity.

Multi Entity Account Info

Standard Service Agreement

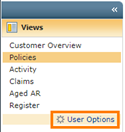

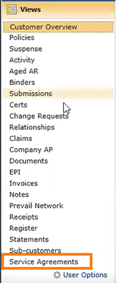

- After selecting your customer, click Service Agreements under the Views section.

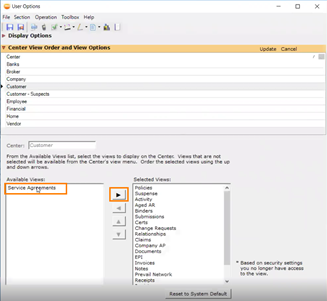

- If the service agreement does not appear in Views, click User Options and add Service Agreements to your Views section. Then click Save and Close.

User Options

Adding Service Agreements

Views: Service Agreements

-

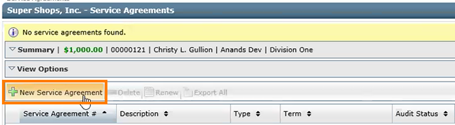

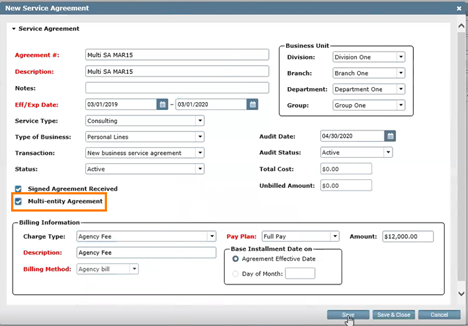

Click New Service Agreement.

Customer: New Service Agreement

New Service Agreement form

- In order to continue you must fill in all fields highlighted in red. This information is crucial for filling out your service agreement.

- Fill in other information that you want included in your Service Agreement:

- Service Type

- Fee Only

- Consulting Only

- You can also add service types in the Administration center.

- Type of Business

- Transaction

- New Business Service Agreement

- Renew Service Agreement

- Business Unit

- This defaults from the business unit of the customer you are creating the agreement for.

- Audit Date

- Populates 60 days after the expire date

- Service Type

- If you have a contract with this customer, you can include that document by clicking the Signed Agreement Received checkbox.

Signed Agreement

-

Select a Charge Type (usually it will be Agency fee).

-

Once you have selected all your options, click Save. You may receive a warning asking if you want to create a Service Agreement that has NOT been flagged as a Multiple Entity Service Agreement. Click Yes.

Multiple Entity Confirmation

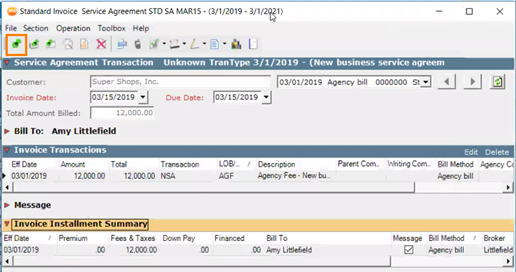

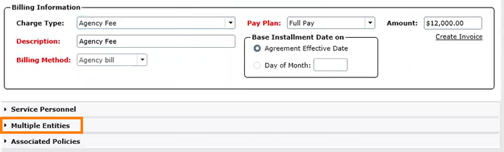

- Two new options will appear at the bottom of the Service Agreement:

- Service Personnel

- Associated Policies

-

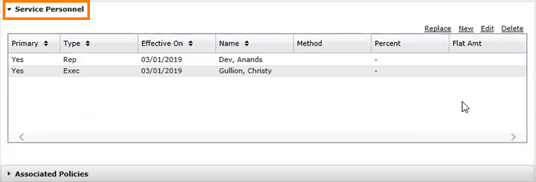

Click the Service Personnel drop-down. Here you will be able to assign employees to the Service Agreement as well as assign commissions.

-

Your options will default to the Primary Exec and Rep, but you are able to edit those options using the Replace, New, Edit and Delete buttons.

Service Personnel

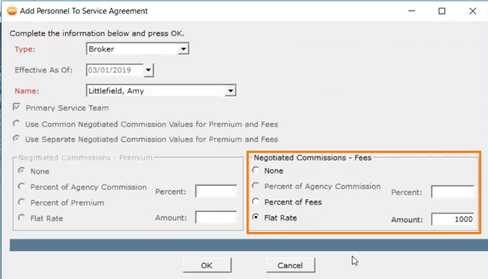

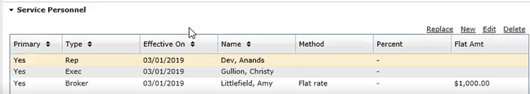

-

If you click New, you can add personnel to your Service Agreement. Here you can designate your personnel and specify the commission fees. Click OK.

-

Add Personnel

New Service Personnel

|

You cannot delete a Primary Exec or Rep from the Service Personnel, but you can Replace both the Primary Rep and Exec. |

-

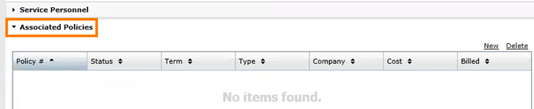

Click the Associated Policies drop-down. You can attach the policies that will need to be audited for the Service Agreement. Begin by clicking New.

Associated Policies

-

Select the policies you want to include and then click Add. You can add as many policies as you want. When finished, click Save.

Add Policies

-

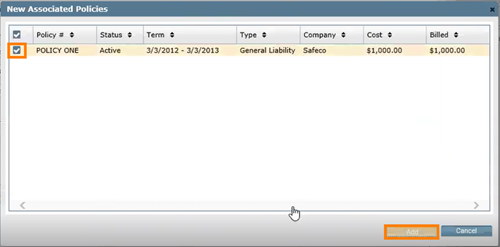

Once you have filled out your service agreement and click Save, you will notice the Create Invoice option under the Billing Information section. Click Create Invoice when you are ready to invoice your Service Agreement.

Create Invoice

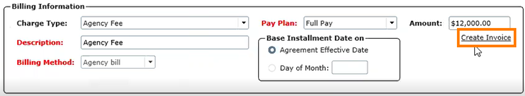

-

If you’re satisfied with your Invoice, you can proceed to Post it. Finally Save and Close your New Service Agreement.

Post Invoice

-

You will now see your new Service Agreement and any associated policies you attached.

New Service Agreement

Multi Entity Service Agreement

- You have the option to make this a multi-entity agreement if you have more than one party involved in the Service Agreement.

Multi-entity Agreement

-

Once you have filled in your Service Agreements information and click Save, you will notice three drop-downs at the bottom of the agreement.

Multiple Entities Drop Down

-

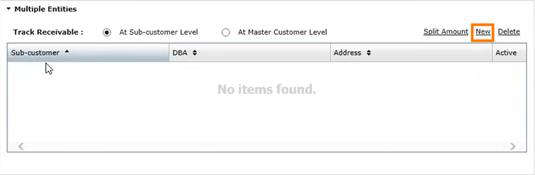

After reviewing your Service Personnel and Associated Policies sections, click the Multiple Entities drop-down.

-

Here you can:

-

Track your receivable at the:

-

Sub-customer Level

-

Master Customer Level

-

-

Split the Amount

-

Add a New Multiple entity

-

Delete a Multiple Entity

-

-

-

When getting started, click New.

New Multiple Entity

-

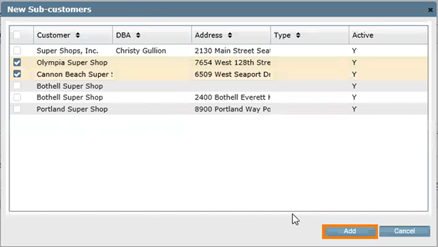

Check the box next to the customers you want to include in your multi-entities agreement. Then click Add.

Adding New Customers

-

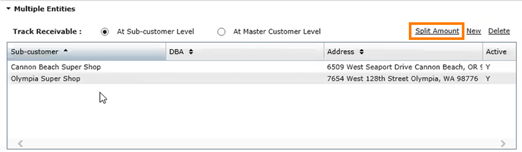

You will see your sub-customers in the report. You can now click Split Amount to decide how the Service Agreement will be paid.

Split Amount

-

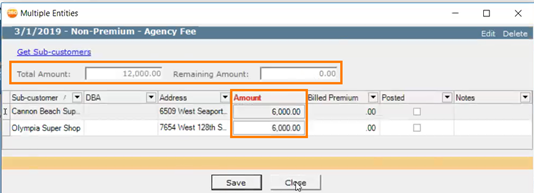

Enter the amount you want each customer to pay so that it equals out to the Total Amount. When the Remaining Amount says $0, you then click Save and Close.

Total Amount

-

Go on to Create Invoice and finish your New Service Agreement.

-

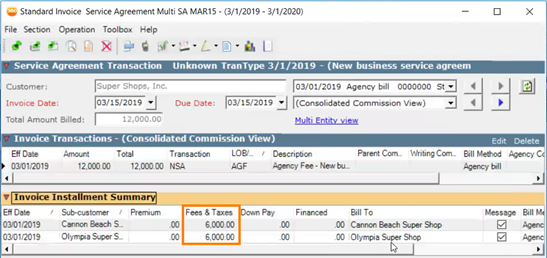

In your Invoice, you will see the multi-entities and their fees/taxes. When finished, Post your Invoice.

Create/Post Invoice

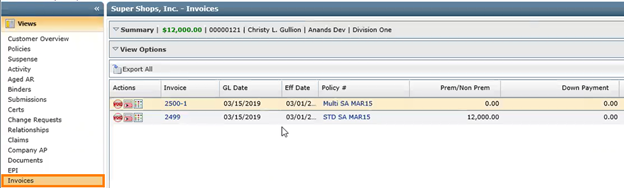

RUN AN INVOICE REPORT

-

In the Views menu, click Invoices. Select the invoice you just created in order to view the invoice report.

Run and Invoice Report

-

You will notice the Service Agreement on the Invoice.

Invoice with Service Agreement

- Workstation coordinator memory consumption improvements.

- Auto-scrolling defect fixed on Change Request winform.

- Billing Charges and Credits – Unable to create a new financed charge type with the recipient as the agency.

- WC Rate not downloading from 6WCR07.