Report: Revenue Recognition - Employee Benefits

Due to regulation stemming from ASC 606, Revenue from Contracts with Customers, Vertafore has created a new accounting feature to help you keep track of recognized revenue as it’s earned through the transfer of promised goods or services to customers.

Starting January 1, 2019, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) will require privately held agencies to keep track of recognized revenue.

For public organizations, the new requirement regarding revenue recognition is effective for any annual reporting periods that begin after December 15, 2017.

For all non-public and not-for-profit organizations, the new requirement regarding revenue recognition is effective for any annual reporting periods that begin after December 15, 2018.

In the 19R1 AMS360 release, you will be able to generate a new Revenue Recognition report that details billed invoices against policies and how much money has been recognized versus earned against policies.

-

You will be able to designate a 12-month window to report on.

-

You will be able to designate different binding % and services % revenue breakdown by various properties (business unit and line of business).

-

The report will generate as an Excel file, and the formulas used to calculate recognized and earned revenue will be viewable within the cells.

-

The report will consider both agency and direct bill scenarios, taking into account the agency commission % and agency fees in billed revenue data points.

-

The Excel report will be locked down to protect the integrity of the data.

HOW TO USE REVENUE RECOGNITION

-

Click Toolbox in the bottom-left hand corner of your screen, then click Classic Reports.

-

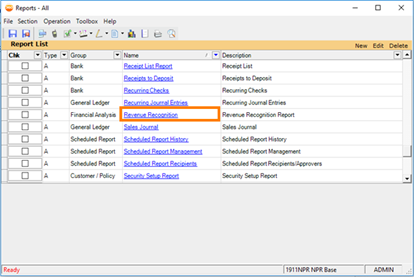

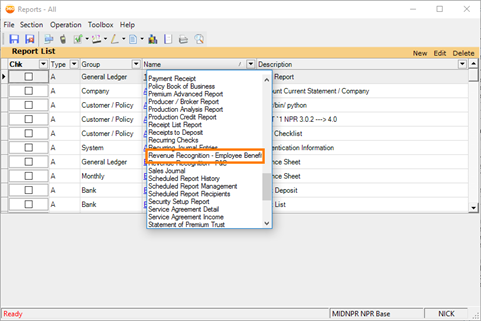

You will be redirected to the Reports - All winform. Scroll down and click Revenue Recognition.

Reports: Revenue Recognition

-

You will now be redirected to the Revenue Recognition report winform.

Revenue Recognition Report

-

Here you can choose to set a range of criteria to include in your report, including:

-

Bill Method: Agency or Direct Bill

-

Type of Business: Personal, Commercial, etc.

-

Lines of Business: All Lines of Business associated with the type of business selected (ex. Type = personal, LOB = personal passenger auto) are available to select.

-

Business Unit: You can filter business units that you have access to. Business unit splits will display on the report as separate line items under the same policy.

-

The default value for all four lines is All.

-

-

Here you can choose to set a range of criteria to include in your report, including:

-

Bill Method: Agency or Direct Bill

-

Type of Business: Personal, Commercial, etc.

-

Lines of Business: All Lines of Business associated with the type of business selected (ex. Type = personal, LOB = personal passenger auto) are available to select.

-

Business Unit: You can filter business units that you have access to. Business unit splits will display on the report as separate line items under the same policy.

-

The default value for all four lines is All.

-

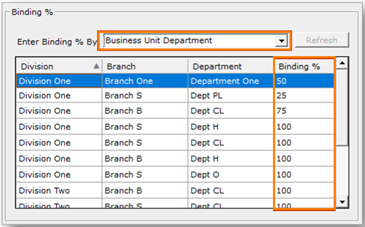

Binding %

-

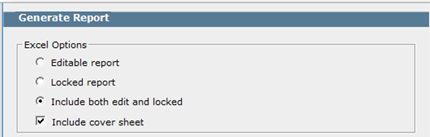

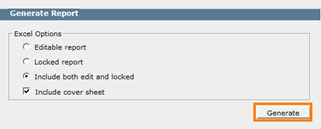

Excel Options:

-

Cover Sheet: This will display an Excel sheet listing the user’s selections/filter criteria.

-

Editable Report: This will allow you to make any changes you wish to the Excel sheet.

-

Locked Report: This option will make it so you cannot make any updates or formatting changes to the Excel sheet.

-

Excel Options

-

Once you finish entering the criteria you wish to have included in your report, click Generate.

-

You will have data for the 11 months prior to the month you select for the report.

-

Example: If you select January 2019 as the end date, the report will pull polices that have an in-force date or are invoiced between February 2018-January 2019

-

Generate Report

-

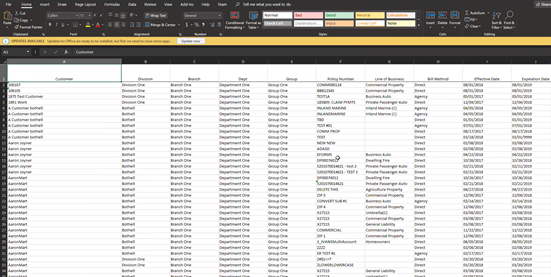

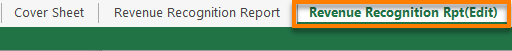

Your report will now be exported to Excel for you to view.

Excel Report

Your Report will Include:

Columns

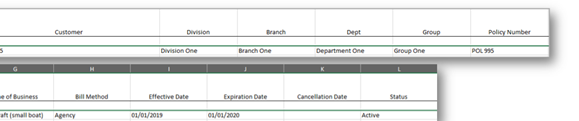

- The First 12 Columns display policy specific information (from the Policy winform)

- Included are:

- Customer Name

- Policy Business Unit

- Policy #

- LOB

- Bill Method

- Eff/Exp Date

- Cancellation Date

- Policy Status

- Each Policy LOB will have its own line item in the report.

- If a policy contains a business unit split, then each part of the split will result in a separate row in the Excel sheet.

Policy Info

Monthly Billed Revenue

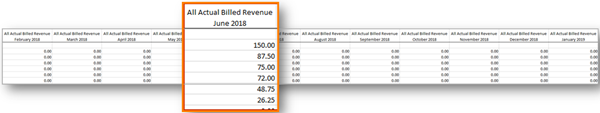

• The report pulls policy revenue data for the trailing twelve months based upon the user entered date.

• The billed revenue dollar amount listed in the report takes into account agency commission percentages of the transaction premium and also agency fees.

Billed Revenue

Total 12 Months Billings - Estimated Contract Value

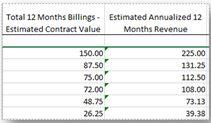

- The summation of the billed revenue over the last 12 months on a policy.

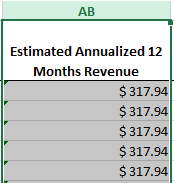

Estimated Annualized 12 Months Revenue

- This estimates the yearly billed revenue as if there were 12 months of billings. This is valuable for when a policy starts halfway through the reporting period. The Estimated Annualized 12 month’s revenue is an estimate, most accurate when the pay plan is monthly.

Estimated Revenues

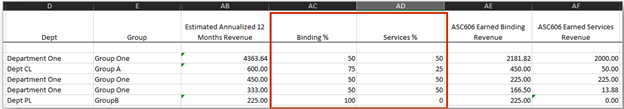

Binding % and Services %

- The Binding % column displays a percentage parameter that is entered by the user in the Report – Revenue Recognition Selections winform prior to report generation.

- The Services % is the percentage of revenue earned by the agency as services are realized by the customer.

- These fields are valuable if the agency wants to differentiate revenue % that is earned at the beginning of the policy duration versus revenue % that is earned as services are provided on a temporal basis over the course of the policy duration.

Binding % and Services %

ASC606 Earned Binding Revenue

This is the estimated earned binding revenue on the current policy, annualized. It is the Estimated Annualized 12 Months Revenue * the Binding %.

ASC606 Earned Services Revenue

This is the estimated earned services revenue on the current policy based on the number of months that services have been delivered on the policy thus far. It is the (Estimated Annualized 12 Months Revenue * Services %) * (Number of months services have been delivered/12).

ASC606 Total Earned Revenue

The is the sum of the earned binding revenue and the earned services revenue. This is the amount of money that has theoretically been EARNED so far on the current policy.

Contract Period Total AMS360 Recognized Revenue

This is the ACTUAL amount of billed revenue against a policy within the report period. This calculation is the sum of all the billed revenue in the report after the policy effective date up to the report date. This number is the concrete dollar amount the agency has recognized via billings.

Unbilled Revenue (Deferred Revenue)

- This column indicates the revenue that the agency has theoretically earned on the contract over the course of a year vs. the amount of money the agency has recognized through billings.

- The report performs this calculation automatically using Excel formulas.

- If the unbilled revenue number is positive, the agency has not yet recognized all revenue on the contract.

- The accuracy of the unbilled revenue number depends on the accuracy of the estimated contract value.

Unbilled Revenue

Before

The Service Agreements total contract value estimation was not being written in the revenue recognition report, this lead to large amounts of negative unbilled revenue.

Now

Service Agreement total contract value estimations will be written to the report, this will lead to accurate calculations.

-

Open up Classic Reports, search for and click the Revenue Recognition – Employee Benefits report.

Classic Reports

Revenue Recognition – Employee Benefits

-

In the Revenue Recognition – Employee Benefits winform, enter the data you want to show up in the report and click on Generate.

Generate

-

Once you are in Excel, navigate to the Editable Revenue Recognition Report tab.

Revenue Recognition Report (Edit)

-

This report will now feature any service agreements that fell during the time period you selected.

-

You will also notice that we modified the Estimated Annualized 12 Months Revenue column (AB).

-

The amount in these fields come from the Service Agreements in AMS360.

-

Estimated Annualized 12 Months Revenue