In this topic, we continue our discussion of configuring the States table, located on the Tables Menu.

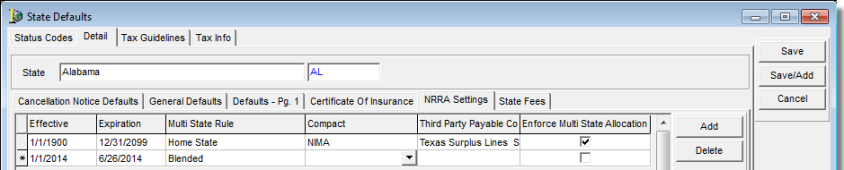

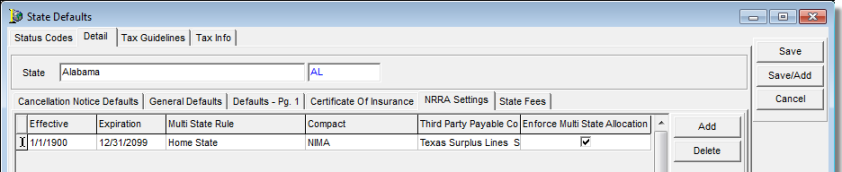

On the NRRA Setttings tab (see Detail), you can enter information about the state pertaining to the Nonadmitted & Reinsurance Reform Act (NRRA).

- Click the NRRA Settings tab. NRRA information is presented in the grid format. Refer to the Configure Multi-State Taxes NRRA topic for more information regarding NRRA setup.

- Click

in a box to select from a list or calendar.

You can press Tab to move between boxes.- Effective (required) – NRRA effective date

- Expiration (required) – NRRA expiration date (required)

- Multi State Rule (required) – rule

that the state is following to comply with NRRA legislation

- Blended – All home state premiums are taxed at the normal home state rates and any out of state premium is taxed at a special blended rate.

- Compact: Member State – The risk state tax rate applies to all risk states within the same compact, but no tax calculation will apply to risk states that are not a member of the home state’s compact.

- Compact State – The risk state tax rate applies to all risk states within the same compact, but a blended rate will apply to those risk states that are not a member of the home state’s compact.

- Home State – All taxes and fees are calculated at the home state rate.

- Inter-State – If the policy is a multi-state policy, a different rate applies to the entire premium.

- Risk State – All states are taxed at their own home state rates. The default tax entity applies unless a third-party payable is designated for the home state.

- Compact – select the compact type:

- NIMA

- SLIMPACT-Lite

- Third Party Payable Company – select if the state uses a third party payable company to collect multi-state taxes, and then select the collecting entity from the list. The list displays tax entities from the Company table.

- Enforce Multi State Allocation – intended for use only in conjunction with the Home State rule, select to enforce the allocation of premium on the Multi-State Allocation tab of the Invoice Transaction Header dialog box in AIM. When enabled for a specific state and multi-state allocation has not been completed by the time you reach the Invoice Transaction Header dialog box, a warning is displayed, and you cannot proceed with the invoice process.

- Press

Tab to add a new row. For example, you can add multiple rules if you need

to expire an old rule and make a new rule effective on a specific date.

Alternatively, you can click Add to add a new row, or click Delete to remove a row.