Process Surplus Lines

The automation of Surplus Lines taxes and fees begins at the Policy Multi Information page. Based on the State Taxes & Fees table, the Filing State of a policy and the Non-Admitted/Admitted status of the policy insurer in that state, the Policy Multi page will pre-fill with additional transaction lines representing the appropriate taxes & fees.

During the manual invoice process in Sagitta, the taxes & fees from the Policy Multi page will pre-fill to the invoice and may be modified as needed.

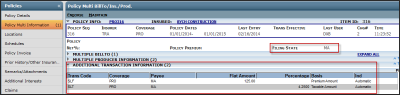

Policy Multi Information page

After creating a new policy in Sagitta, access the Policy Multi Information page.

Important: It is necessary to access and save the page in order for the data on it to be recognized during the invoicing process.

- The Filing State will pre-fill with the State from the Policy Details page. It can be overridden if needed.

- The Additional Transaction Information section automatically pre-fills with data from the State Taxes & Fees table based on the Filing State of the policy and the Non-Admitted/Admitted status of the insurer.

- The information in the Additional Transaction section may be edited to reflect any special policy fees or any changes to the information that pre-filled. Double-click on the line you to be changed, or click Add to enter a new line.

|

Transaction |

Pre-fills from the State Taxes & Fees table and represents the transaction code that will show on the invoice |

|

Coverage |

Pre-fills from the Policy Details page |

|

Payee |

Pre-fills from the State Taxes & Fees table If the Payee on the Policy Details page is responsible for filing (a flag set in the Payee Codes Maintenance page), the Payee on the policy will override what’s in the table. |

|

Flat Amount |

Pre-fills from the State Taxes & Fees table and represents the amount of the Tax/Fee if it is a Flat Amount. Note: For each transaction, either a Percentage or a Flat Amount must be selected in order for the line to be saved.

|

|

Percentage |

Pre-fills from the State Taxes & Fees table and represents the amount of the Tax/Fee if it is a Percentage. Note: For each transaction, either a Percentage or a Flat Amount must be selected in order for the line to be saved. |

|

Basis |

Pre-fills from the State Taxes & Fees table and shows whether the invoice will calculate the transaction line using the total Premium amount or the total Taxable amount. Applicable when the Percentage field is defined. |

|

Taxable? |

Pre-fills from the State Taxes & Fees table and defines whether this transaction is taxable. Yes or No. May only equal Yes if the rate Basis is Premium. |

|

Rounding |

Pre-fills from the State Taxes & Fees table and defines whether the invoice will round the calculated amount to the Nearest Penny or Nearest Dollar. |

|

Multi-BillTo Prorated/Repeated |

Defaults to Prorated. This field is used in Multi-BillTo scenarios to determine whether this transaction line repeats for each BillTo, or is pro-rated among the number of BillTo codes. |

|

Indicator |

When the line is pre-filled from the State Taxes & Fees table, the indicator will reflect “A” for automatic. If the line is subsequently edited, or, if a new line is added, the indicator will display the letter “M” for manual. The indicator field is display only. |

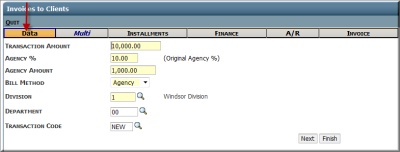

Invoices to Clients

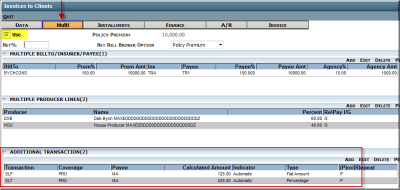

When manually invoicing premium, the Invoices to Clients – Multi tab will pre-fill with the information saved at the Policy level.

After the Transaction Amount is entered on the Invoices to Clients – Data tab and the information is saved, taxes and fees are calculated and can be seen on the Multi tab.

The user may access the Multi page to verify amounts, add invoice fees or make changes as needed.

Note: the system can be personalized to always “Use” the Multi information, or, require the user to check the “Use” box each time. This setting may be found in the Accounting Flags page.

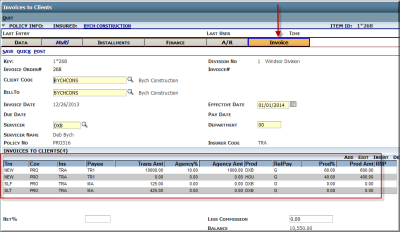

The final Invoice tab will reflect the invoice lines as determined by all previous tabs. You may also make manual changes on this tab as needed.

Invoice Corrections

The standard Sagitta Revise function used to make corrections to invoices takes the user directly to the Invoices to Clients – Invoice tab. Because the automation of taxes and fees occurs on a tab prior to the Invoice tab, revisions will not automatically refresh tax and fee lines.

If you wish to have the system automatically pre-fill tax and fee lines on invoice corrections, the Void function should be used, followed by the creation of a new invoice.

Policy Multi Information on Renewal/Rewrite/Remarket Transactions

The Accounting Flags option Automatically Copy Policy Multi Information on Renewal, Rewrite or Remarket flag instructs the system on whether to copy the Policy Multi Information page to the new term/record. When Surplus Lines is turned on, the Additional Transactions section of the Policy Multi page will be cleared and re-populated based on the contents of the State Taxes & Fees for that Filing State. This will enable to system to recognize new rates or other changes.

Note: Transactions that were manually entered in the prior term will also be cleared.

Reporting Changes

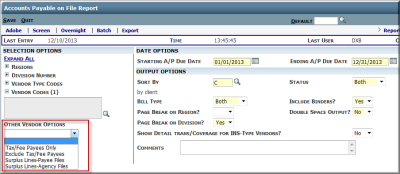

The Accounts Payable on File report has been enhanced to include Other Vendor Options as part of the selection criteria.

|

Tax/Fee Payees Only |

Generate a listing of payables attached to payees with the Tax/Fee Payee flag set to Yes |

|

Exclude Tax/Fee Payees |

Generate a report of payables that do not include records attached to payees with the Tax/Fee Payee flag set to Yes |

|

Surplus Lines – Payee Files |

Generate a list of payables attached to payees with the Payee Responsible for Filing flag set to Yes |

|

Surplus Lines – Agency Files |

Generate a report of payables attached to payees with the Payee Responsible for Filing flag set to No |

When Other Vendor Options are selected, specific Vendor Type Codes or Vendor Codes may not be entered as part of the selection criteria.