In this topic, we continue our discussion of managing commercial property on the Commercial tab in Units At Risk.

On the Limits – Property tab you can specify theft and wind coverages and deductibles for the selected property. You can also enter subjects of insurance to be covered as well as limits for those subjects.

In the following table, we provide a brief description of the buttons exclusive to the Limits – Property tab.

|

Button |

Function |

|---|---|

|

|

Add a new subject of insurance record |

|

|

Edit the selected subject of insurance record |

|

|

Delete the selected subject of insurance record |

|

|

Save changes to the selected record |

|

|

Cancel changes to the selected record |

In the steps that follow, we show you how to edit the theft and wind coverages for the property. Later, we show you how to add a subject of interest for the property.

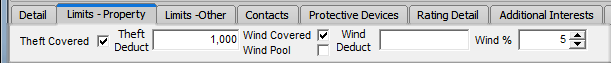

- On the

Limits – Property tab, use the boxes provided to enter specifics about theft and wind coverage and deductibles.

- Theft Covered – indicates whether theft is covered for this property

- Theft Deduct – theft deductible amount

- Wind Covered – indicates whether wind damage is covered for this property

- Wind Pool – indicates whether windpool coverage is enabled for this property

- Wind Deduct – wind damage deductible amount

- Wind % – percentage of wind expected

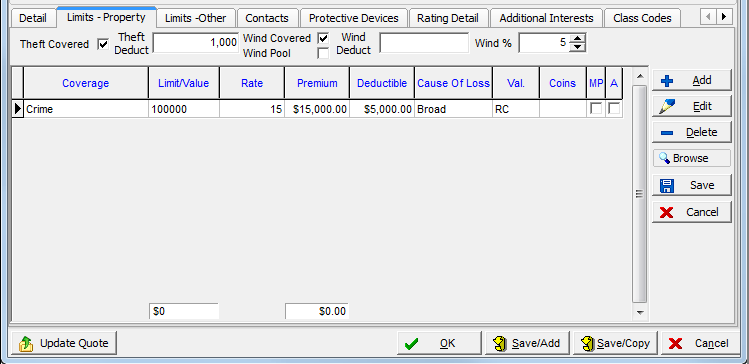

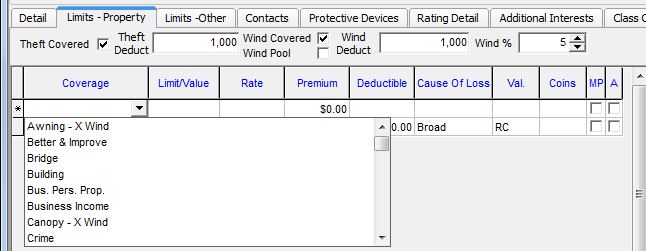

- Click Add to add a new subject of insurance.

- In the

grid, click in a column to enter

information. In some columns, such as Coverage, you will be presented

with a list from which you can make a selection. In the other columns,

you can simply enter the information necessary.

- Coverage – coverage for the selected property, that is, unit at risk

- Limit/Value – coverage limit or value of the selected property

- Rate – reflects a flat amount or a percentage used in calculating the amount

- Premium – premium amount

- Deductible – deductible amount

- Cause of Loss – cause of loss for the selected property

- Val – valuation method for the property:

- ACV – actual cash value

- RC – replacement cost

- Coins – default coinsurance amount to be used during the quote/bind process

- MP – indicates whether the selected unit has a minimum premium

- A – indicates whether the selected unit has an additional unit at risk

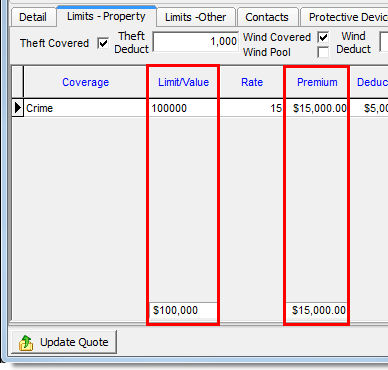

Once you have added the subject of insurance, the total amounts for the Limit/Value and Premium columns are displayed in the unlabeled boxes below the grid.