Processing with Multiple Tax Rates

For states that charge municipality taxes, a feature has been added to AIM that will allow you to manage those taxes where multiple municipalities apply. The following is an illustration of that functionality.

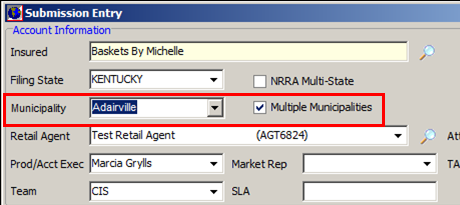

On the Submission Entry screen, the Multiple Municipalities option indicates that the submission has multiple municipalities.

- For a single municipality, click

to select the name of the municipality. For multiple municipalities, select Multiple Municipalities.

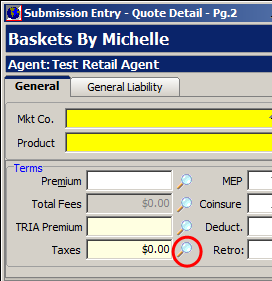

to select the name of the municipality. For multiple municipalities, select Multiple Municipalities. - In Submission Entry-Quote Detail-Pg. 2, enter the Premium, Total Fees, and TRIA Premium.

- Click

to the right of the Taxes box to open Multi-Municipality Tax Distribution.

to the right of the Taxes box to open Multi-Municipality Tax Distribution.

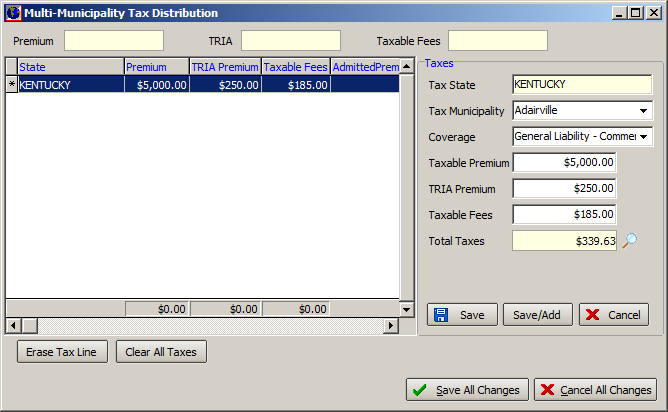

- In the Tax Municipality, select the first municipality.

- In Coverage, select a coverage.

- In Taxable Premium, enter the amount of premium attributable to this municipality.

- In TRIA Premium, enter the amount of TRIA premium that is attributable to this municipality.

- In Taxable Fees, enter the total of fees attributable to this municipality.

|

Notice that as amounts are entered and you tab out of those fields the Total Taxes field automatically calculates. |

- Click

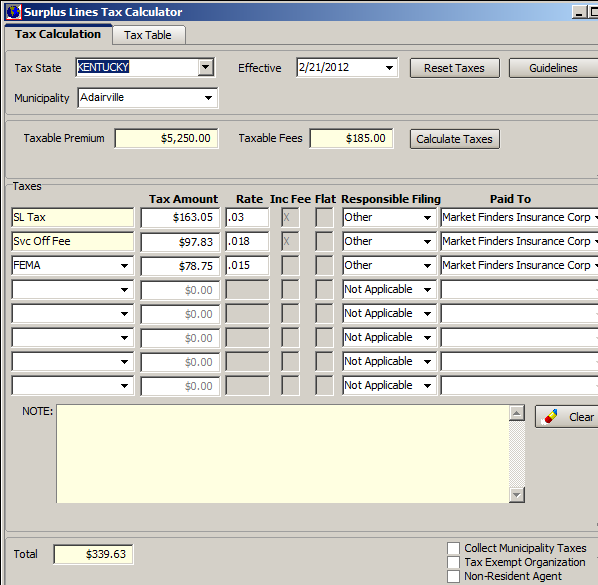

to the right of the Total Taxes box to open the Surplus Lines Calculator for the selected municipality. It is not necessary to open the tax calculator for each municipality calculation in order to save it.

to the right of the Total Taxes box to open the Surplus Lines Calculator for the selected municipality. It is not necessary to open the tax calculator for each municipality calculation in order to save it.

- Review the taxes for the municipality and make changes as needed, and then click OK to save your changes and close Surplus Lines Tax Calculator, or click Cancel to close without saving your changes.

- Click Save/Add to add additional municipalities.

- To delete a tax line, highlight the lines and click the Erase Tax Line.

- To delete all tax lines, click Clear All Taxes.

- Save all changes when complete.