In this topic we continue our discussion of multi-state NRRA taxes that we began in Multi-State Taxes NRRA.

When the home or interstate rules apply, you are still able to edit the tax allocation without the need to reverse the invoice and re-bind the submission, provided the invoice has not yet been transmitted via the TXSLOT tax reporting module.

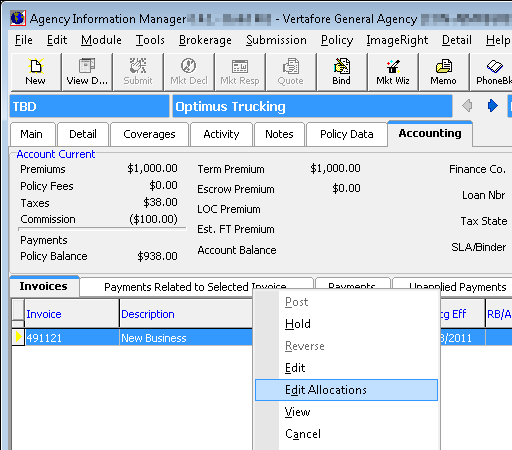

- On the Accounting tab, right click the invoice to see the menu.

- Click Edit Allocations.

- In the Multi-State Allocation dialog box, edit the allocations.

- When editing is complete, click Save to save your changes.

|

If the invoice has already been transmitted to the TXSLOT, the Edit Allocations option will not be available. To make revisions you must reverse the invoice and re-invoice with the correct allocation. |