In this topic we continue our discussion of multi-state NRRA taxes that we began in Multi-State Taxes NRRA.

In the steps that follow, we show you how to process a new home or interstate submission in compliance with NRRA for home and interstate submissions.

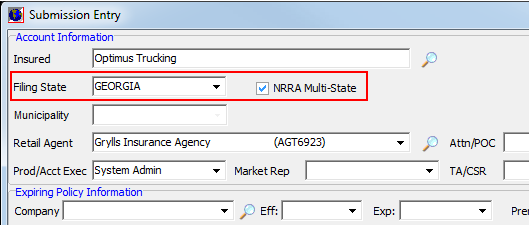

- In the Filing State list, located in Submission Entry, select the home state.

- Select NRRA Multi-State.

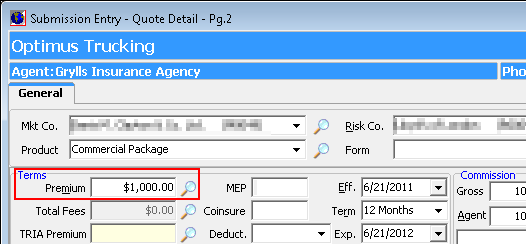

- In Submission Entry – Quote Detail – Pg. 2, enter the taxable fees and TRIA premium amounts. In the Premium box, enter the premium and press TAB.

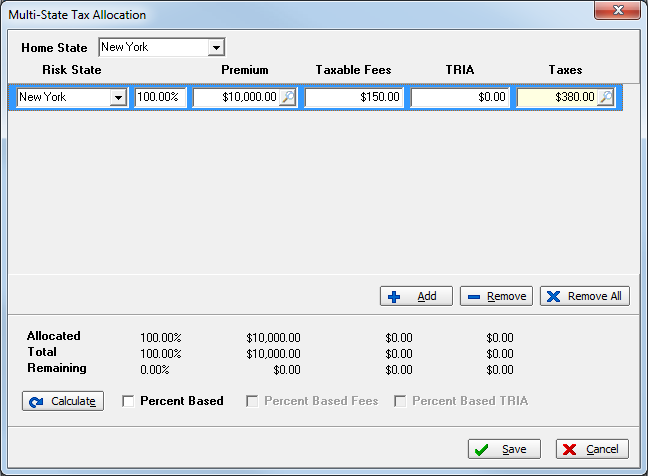

- The home state is selected by default. The premium, taxable fees and TRIA being allocated 100% to the home state. Click Save to save the multi-state allocation without making any changes.

- Click

in the Premium box to adjust premium distribution, if applicable.

in the Premium box to adjust premium distribution, if applicable. - Click

in the Taxes box to use Surplus Lines Tax Calculator to adjust single state taxes, as required.

in the Taxes box to use Surplus Lines Tax Calculator to adjust single state taxes, as required. - Bind the policy as required.

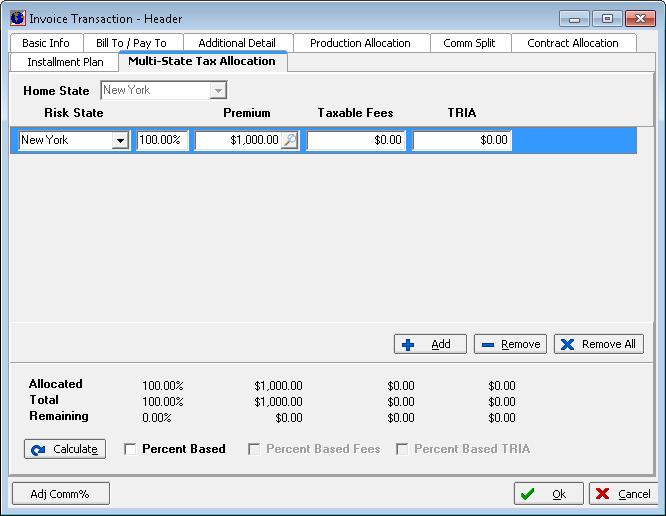

- In Invoice Transaction Header, click the Multi-State Tax Allocation tab to display the calculator.

- Click a box to change the allocation amounts for the home state. Press TAB to move through the row.

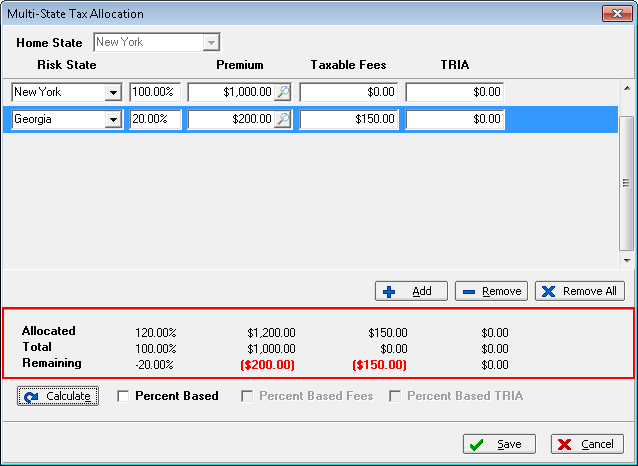

- Click Add to add additional rows. Alternatively, you can click Remove to remove an individual row or Remove All to remove all rows of allocation.

- Select the appropriate option to calculate the premium, taxable fees and TRIA allocations by percentage rather than by entering a dollar amount. This feature can only be used if premium allocation is not used on any of the tax rows.

- Percent Based

- Percent Based Fees

- Percent Based TRIA

- Click Calculate to calculate premiums, taxable fees, and TRIA totals. Any discrepancies are displayed in red.

- When allocations and calculations are complete, click Save and proceed to post the invoice.