In this topic we continue our discussion of multi-state NRRA taxes that we began in Multi-State Taxes NRRA.

Whether the renewal submission is created via Renewal Manager or via the Quote Renewal menu option, AIM updates the submission record automatically when multi-state is involved.

What follows is an outline of what to expect when renewing a submission that incepted prior to July 21, 2011 and is renewing after July 21, 2011.

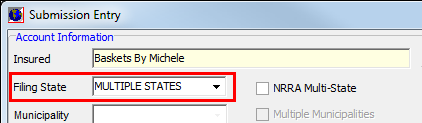

The filing state for the expiring policy is already set to Multiple States.

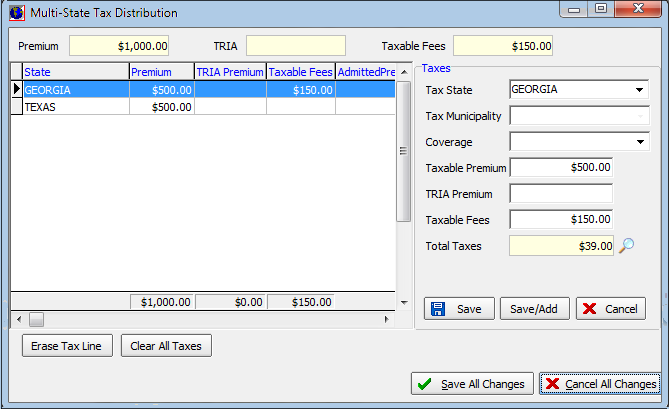

The multi-state taxes were completed when the policy was bound.

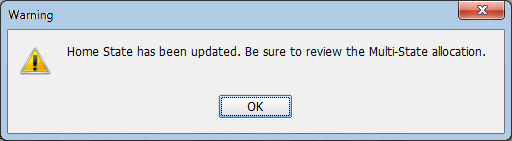

When opening the renewal record for the first time, a warning message is displayed.

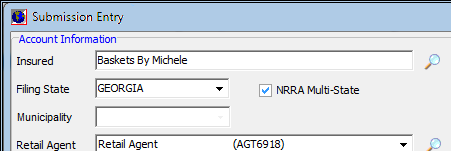

Note that Filing State has been reset from Multiple State to the home state, as determined by the physical location address of the insured. Also notice that the NRRA Multi-State option has been selected.

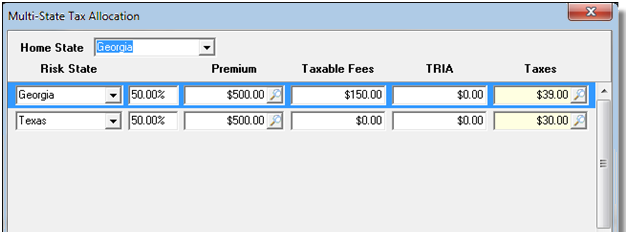

The multi-state tax allocations are carried over from the expiring policy record.