Revenue Recognition Report 20R2 Enhancements

|

Note: This update is part of the AMS360 20R2 release. Navigate to the AMS360 2020 20R2 Release Notes to review other enhancements and fixes that were part of the release. |

We have made several enhancements to both Revenue Recognition reports (Employee Benefits and P&C) with the overall goal of condensing data and improving data integrity.

-

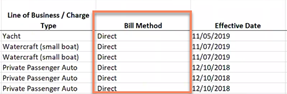

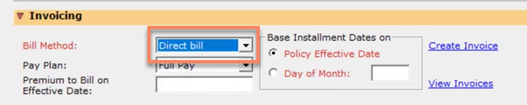

The Bill Method column will now pull from invoices. If a policy is unbilled it will be pulled from the Policy.

Revenue Recognition Report: Bill Method

-

Submission and Deleted policies have been removed from the Revenue Recognition Report.

-

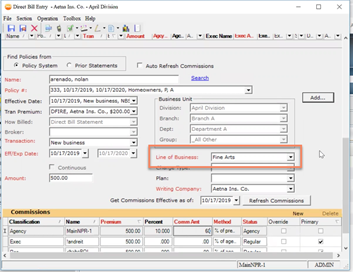

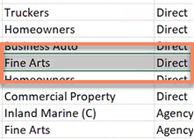

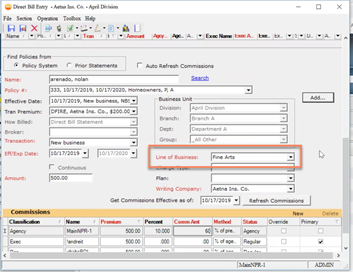

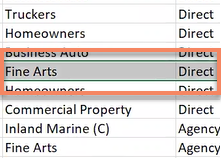

The Line of Business column will now pull from the invoice for Direct Bill Entry billing.

Direct Bill Entry: LOB

Revenue Recognition Report: LOB

-

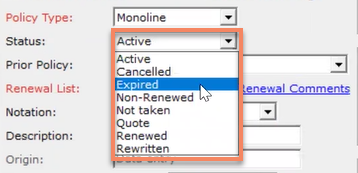

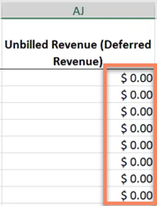

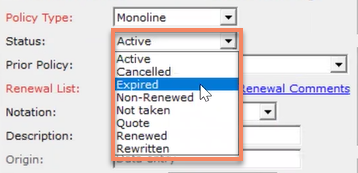

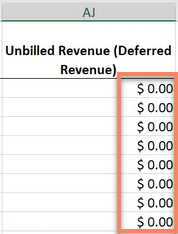

Policies with a status of Renewed, Expired or Canceled will now display $0 for the Unbilled Revenue column.

Status

Revenue Recognition Report: Unbilled Revenue

-

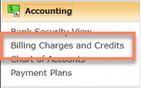

Agency Commissions for non-premium fee charges will now display in the report as individual line items.

Custom Charge Type

-

In the Administration center, click on the Accounting tab and then click on Billing Chargers and Credits. In the Billing Charges winform, click on New.

Billing Charges and Credits

-

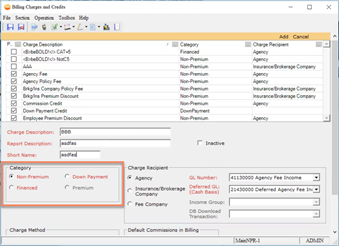

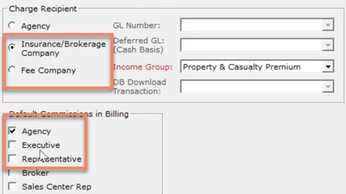

Fill in the required info and in the Category section, click on Non-Premium. Then, under the Charge Recipient section, click on Insurance/Brokerage Company. Next, click on Agency under the Default Commissions in Billing Section.

Billing Charges and Credits: Category

Billing Charges and Credits: Charge Receipt

-

Finally, when you are ready click on Add and then Save and Close.

Policy View

-

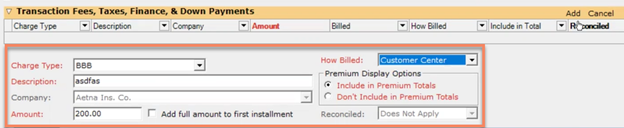

When you open the Policy winform you will now see your new custom charge type under the Transaction Fees, Taxes & Down Payments section. Fill in the Amount and How Billed sections and when you are ready, click on Add.

Policy: Charge Type

-

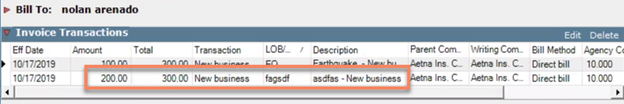

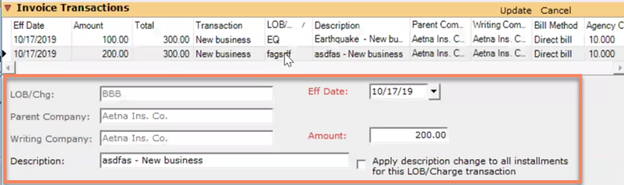

Under the invoicing section, click on Create Invoice. In the Standard Invoice winform you will now see your new Invoice Transaction. When you are ready, post the invoice and generate the Revenue Recognition report. You will now be able to find your new custom charge.

Bill To

Invoice Transactions

Revenue Recognition Report: Invoice Transactions

-

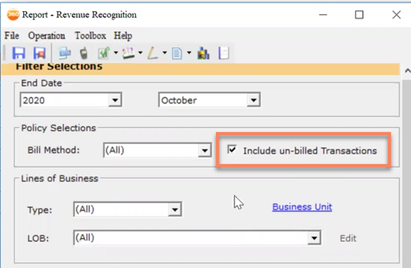

There is now a filter on the Revenue Recognition report that will show/hide unbilled transactions.

-

It is checked by default.

Include un-billed Transactions

-

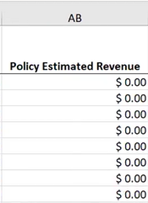

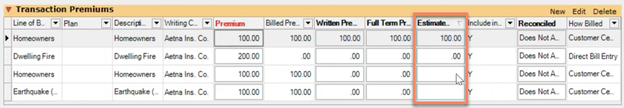

The Policy Estimated Revenue field has been added as a column in the Revenue Recognition report.

Policy Estimated Revenue Column

Estimated Revenue Info

-

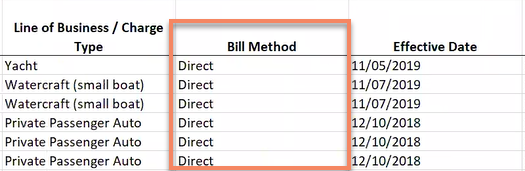

The Bill Method column will now pull from invoices. If a policy is unbilled it will be pulled from the Policy.

Revenue Recognition Report: Bill Method

Invoicing: Direct Bill

-

Submission and Deleted policies have been removed from the Revenue Recognition Report.

-

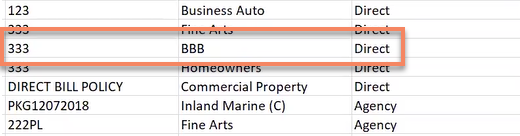

The Line of Business column will now pull from the invoice for Direct Bill Entry billing.

Direct Bill Entry: LOB

Revenue Recognition Report: LOB

-

Policies with a status of Renewed, Expired or Canceled will now display $0 for the Unbilled Revenue column.

Status

Revenue Recognition Report: Unbilled Revenue

-

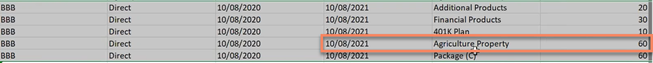

Direct Bill Entry invoices have been added to the Revenue Recognition report and will appear as individual line items.

-

If a policy line of business matches a Direct Bill Entry line of business, then it will consolidate into a single row in the report.

Direct Bill Entry: 1 LOBs

-

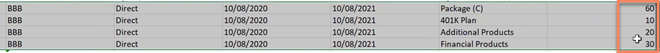

If a policy has several Lines of Business and a Direct Bill Entry Invoice Line of Business is used that does not match (such as Package) then the resulting row in the report will aggregate all policy estimated revenue fields for that billed row.

Direct Bill Entry: Multiple LOBs

-