In this topic, we continue our discussion of multi-state taxes that we started in Configure Multi-State Taxes NRRA.

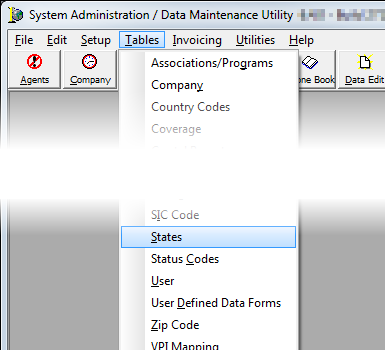

In DMU, system administrators can set NRRA related tax rules for each state in the State table.

- On the Tables menu of Data Maintenance Utility (DMU), click States.

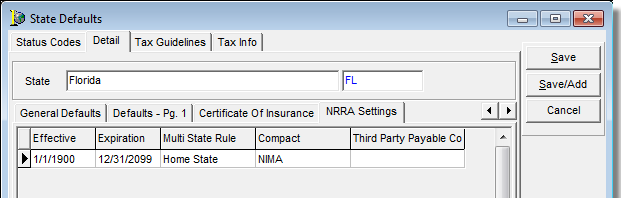

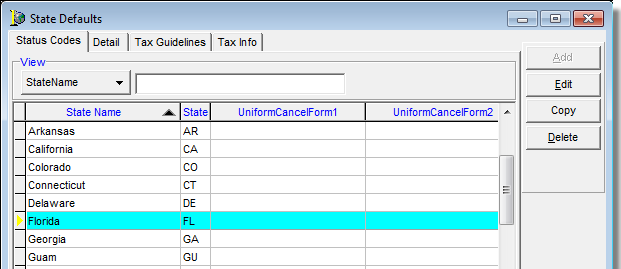

- In State Defaults, select the state.

- Click Edit.

- Click the NRRA Settings tab.

You may need to click or

or to locate the tab.

to locate the tab.

|

When the state tax rule is changed, existing quote records are not updated. The user must manually edit any quotes affected by the change. To do so, open the AIM Multi-State Tax Allocation dialog box and click the Taxes magnifying glass for each tax row. Click the Reset Taxes button for each individual state. |

-

Enter information about the state pertaining to NRRA in the fields:

- Effective and Expiration Dates – State rules change frequently, use these fields to indicate when tax rules may have changed.

- Multi State Rule – The rule that the state is following to comply with NRRA legislation as outlined earlier in this document.

- Compact – indicates that the state is in a compact. Select the compact type:

- NIMA

- SLIMPACT-Lite

- Third Party Payable Company – If the state uses a third party payable company to collect multi-state taxes, select the collecting entity from the list. The list displays tax entities from the Company table.

- Click Save to save your changes, Save/Add to save your changes and add a new state, or click Cancel to abandon your changes.