Configure the Tax Table

In this topic, we continue our discussion of multi-state taxes that we started in Configure Multi-State Taxes NRRA.

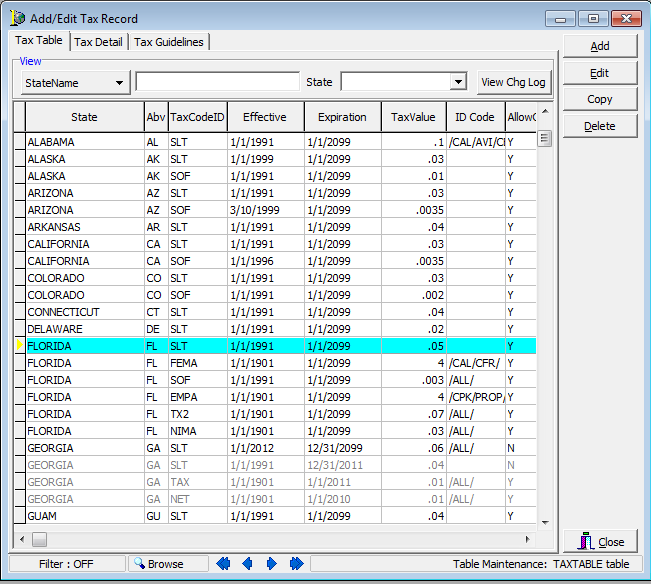

The system administrator can set NRRA related tax rules for each tax using settings in the Tax table. The following example uses the state of Florida as illustration encompassing the surplus lines tax, stamping office fee, and the NIMA clearinghouse fee.

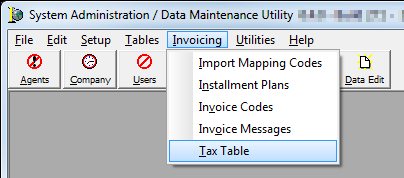

- On the Invoicing menu, click Tax Table.

- In Add/Edit Tax Record, select the state.

- Click Edit.

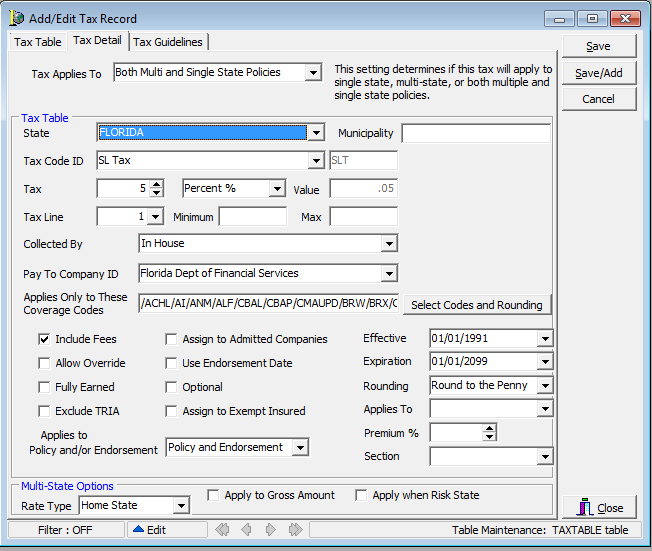

- In the Tax Applies To field, select from the following options:

- Both Multi and Single State Policies

- Multiple State Policies Only

- Single State Policies Only

Using Florida as an example, we would select Single State Policies Only for the stamping office fee, Both Multi and Single States for surplus lines tax, and Multiple States for NIMA clearinghouse.

- In the Multi-State Options group box, enter the Non-admitted and Reinsurance Reform Act (NRRA) multi-state tax rules, if applicable.

- Rate Type – The specific tax rule set that will be applied to the tax calculation. The list is only available when Surplus Lines Tax or Stamping Office Fee is selected in the Tax Code ID list.

- Blended – All home state premiums are taxed at the normal home state rates and any out of state premium is taxed at a special blended rate.

- Home State – All taxes and fees are calculated at the home state rate.

- Inter-State – If the policy is a multi-state policy, a different rate applies to the whole premium.

- Apply to Gross Amount – Applies the tax to the total amount of the premium when the tax is in the home state. This option should also be selected for NIMA clearinghouse.

- Apply when Risk State – Applies the tax to the amount of the risk state only when the tax is from the risk state when the home state is using the risk state rule. For example, if Georgia is the home state for the policy and is using the risk state rule, with premium being allocated in Florida, select this option to determine which taxes, from Florida, apply to the Florida premium.

- Rate Type – The specific tax rule set that will be applied to the tax calculation. The list is only available when Surplus Lines Tax or Stamping Office Fee is selected in the Tax Code ID list.

For any state not using the home state rule or risk state rule, a second tax record needs to be created for the home state rate and for any special rate. For example, if a state implements the blended rule, and it applies a 5% in state rate and a 7% rate for all premiums outside of the state for the surplus lines tax (SLT), then two taxes are required for SLT; one tax set as home state at 5% and one blended at 7%.

The Apply to Gross Amount and Apply when Risk State options become available when you have selected a valid tax ID code. Tax ID codes are maintained as part of an invoice transaction code in DMU. Please refer to the DMU help file for information on creating or editing invoice transaction codes.