InsurLink 2024 R2 for AMS360 and Sagitta Release Notes

Vertafore is pleased to release InsurLink 24R2 for AMS360 & Sagitta. With each release, we are incrementally improving and updating InsurLink to provide you with the best possible experience.

New Elements

DRAG & DROP

-

Previously: When the new user interface (UI) was initially presented, we were missing the ability to drag and drop files in the new Client Admin UI.

-

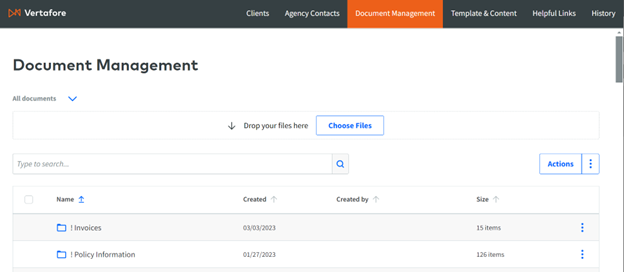

Now: We have brought back drag and drop while instituting some minor, beneficial changes (see screenshot):

-

•The drag-and-drop field now appears at the top of the page.

-

To upload multiple files at the same time, highlight all the files you wish to upload and then drag that group of files into the designated file-drop area.

-

To upload files to a specific folder, you must first click into the folder where the files will be placed; then, drag and drop the desired uploaded files into that folder.

MULTIPLE FILE UPLOADS

-

Previously: In the new Client Admin UI, you were unable to select multiple files to be uploaded.

-

Now: You can highlight multiple files for uploading and rename and share them in an email, as desired. This functionality behaves identically to the same process included in the previous Client Admin UI.

Issues Fixed

| DE44863 |

Sagitta Client Admin (Document Management): Grid size larger than with other pages |

-

Original Issue: When launching the Document Management tab for Sagitta/InsurLink, the grid size for the table was sized incorrectly.

-

Fix Deployed: We have adjusted the grid size so that users no longer need to scroll to reach the kebab menu items. As a part of this fix, Sagitta users will see the side bar is no longer present. However, there is no resulting loss of functionality

| DE46673 |

DE47264 IL Agency Admin: Bulk Template CSV downloading error |

-

Original Issue: Attempts to download the Bulk Template CSV resulted in empty .csv files.

-

Fix Deployed: Downloading the CSV will now contain all relevant information as to who was affected by the job and to which template they switched.

| DS10663 |

DE47264 Agency User UI: Ampersand ("&") symbol not properly parsed for custom invites; cuts off all following text when "&" (or other special characters) are added. |

-

Original Issue: When adding an “&” to an email body in Agency Admin, the actual invitation would cut off all text that followed the placement of that symbol.

-

Fix Deployed: Text will no longer cut off within the email body when “&” is present.

| DS10751 |

InsurLink NPR 24R1 Link document to policy not working |

-

Original Issue: When a PDF had its file extension capitalized, this action was causing errors when linking it to a policy.

-

Fix Deployed: Users can now link PDFs to policies, even where the extension is capitalized.

| DS10813 |

InsurLink 24R1 (Customer Admin): Unable to upload / download files larger than 30MB |

-

Original Issue: Users were unable to upload / download files that were greater in size than 30MB.

-

Fix Deployed: Users can now upload / download files up to 200MB in size, which is the same limitation that existed with the previous Client Admin interface.

| DS10690 |

InsurLink: InsurLink activities not created in AMS360 from new UI |

-

Original Issue: Activities were not being generated when sharing documents derived from Client Admin in the new UI.

-

Fix Deployed: The new UI now generates activities once a document is shared.

| DS10713 |

InsurLink update: Modifying other agency employees |

-

Original Issue: When searching for other agency employees, this list differed when comparing the old and new Client Admin UI.

-

Fix Deployed: The new Client Admin UI had its limitations removed; both old and new lists now return the same number of employees.

| DS10745 |

InsurLink NPR (Customer Admin): Standard Invite email message formatted incorrectly |

-

Original Issue: The invite email body was not formatted as set within Agency Admin.

-

Fix Deployed: Spacing and formatting is now displayed as designed in Agency Admin.

| DS10659 |

Insurlink: PayMyPremiums integration error — "Invalid Enrollment Key" |

-

Original Issue: There existed a character restriction whereby leading with special characters prohibited users from saving an enrollment key.

-

Fix Deployed: We removed this restriction so that users may now save enrollment keys in the new UI.