In this topic, we continue our discussion of theCompany table located on the Tables Menu.

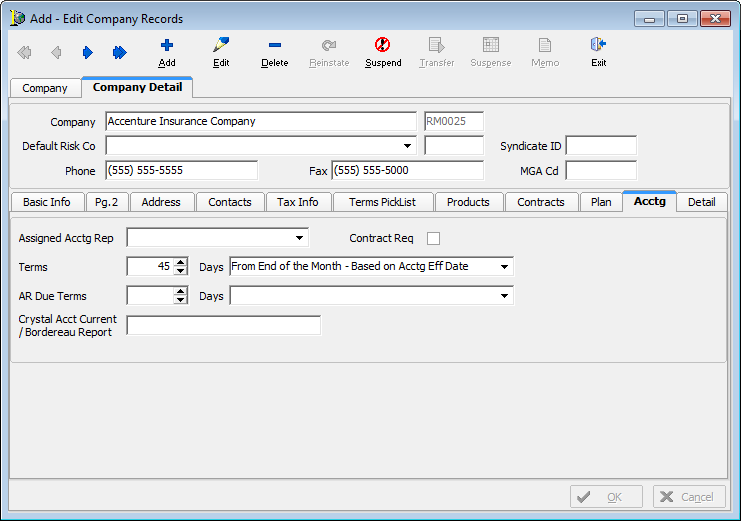

You can use the Acctg tab to maintain accounting terms for companies with which your agency does business. It is important to understand the hierarchy of accounting terms in the AIM system to ensure that due dates in your AIM system are being calculated properly.

Accounts Payable (AP) Terms

In the Company table, the Terms and Days fields override the settings configured for the Default Invoice Terms A/P and the Days From fields on the Invoicing tab in System Parameters.

Accounts Receivable (AR) Terms

In the Company table, settings configured for the AR due terms and days fields override the same settings configured on the Acctg tab in the Retail Agent/Broker table (see Retail Agent/Broker Acctg). The settings in the Retail Agent table override the Default Invoice Terms (AR) and the Days From the fields in System Parameters.

- In the Assigned Acctg Rep list, select the person in your agency that is the designated accounting representative for the carrier.

- Select the Contract Req. option if a contract number is required when invoicing a submission bound with the carrier.

- Use the Terms box and the Days list together to create default due date terms.

In the Terms box, type or select the default terms, in days. - In the Days list, located to the right of the Terms box, select the parameter by which the default due date is to be calculated. The parameters are explained in the following table.

| Parameter | Due date is calculated using the |

|---|---|

| From End of Month - Based on Acctg Eff Date |

Later of the policy effective date or invoice date beginning at the end of the month. |

| From End of Month - Based on Invoice Date |

Invoice date beginning at the end of the month. |

| From End of Month - Based on Policy Eff Date |

Policy effective date beginning at the end of the month. However, if the policy was effective before the current date, the current date will be used. |

| End of the 2nd Month - Based on Accounting Eff Date |

Later of the policy effective date or invoice date beginning at the end of the next month. |

| End of the 2nd Month - Based on Invoice Date |

Invoice date beginning at the end of next month. |

| End of the 2nd Month - Based on Policy Eff Date |

Policy effective date beginning at the end of next month. However, if the policy was effective before the current date, the current date will be used. |

| End of the 3rd Month - Based on Acctg Eff Date |

Later of the policy effective date or invoice date beginning at the end of the month after next. |

| End of the 3rd Month - Based on Invoice Date |

Invoice date beginning at the end of the month after next. |

| End of the 3rd Month - Based on Policy Eff Date |

Policy effective date beginning at the end of the month after next. However, if the policy was effective before today, today’s date will be used. |

| Prior to Due Date to Carrier | Reserved for future development. |

| From Acctg Eff Date |

Later of the policy effective date or invoice date. |

| From Invoice Date | Invoice date only. |

| From Policy/Endorsement Eff Date |

Policy or endorsement effective date. However, if the policy or endorsement was effective before the current date, the current date will be used. |

| From Beginning of the Month - Based on Acctg Eff Date |

Later of the policy effective date or invoice date beginning at the start of the current month. |

| From Beginning of the Month - Based on Invoice Date |

Invoice date beginning at the start of the current month. |

| From Beginning of the Month - Based on Policy Eff Date |

Policy effective date beginning at the start of the current month. However, if the policy was effective before the current date, the current date will be used. |

| Special – Prompt User for Due Date |

Due date entered manually by the user in the AIM Invoice Transaction - Header dialog box. |

| From Invoice Date OR 30 days from Effective Date |

Invoice date or 30 days from the effective date. |

- In the AR Due Terms box, type the default terms, in days.

- In the Days box, located to the right of the Terms box, select the parameter by which the default due date is to be calculated, using the parameter definitions provided earlier.

- In the Crystal Acct Current/Bordereau Report box, type the file path to the location of the account current Bordereau report if applicable.