In this topic, we continue our discussion of managing garage coverage on the Garage tab in Units At Risk.

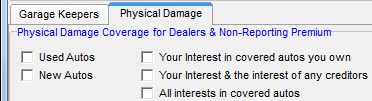

On the Physical Damage tab, you can provide information about garage coverage for garage owners such as automobile dealers.

- In the

Physical Damage Coverage for Dealers & Non-Reporting Premium pane,

select any of the options that apply.

- Used Autos – indicates whether the selected policy covers used automobiles

- New Autos – indicates whether the selected policy covers new automobiles

- Your Interest in covered autos you own – indicates whether the selected policy covers the garage owner's interest in autos that he owns

- Your Interest & the interest of any creditors – indicates whether the selected policy covers the garage owner's interest and the interest of any creditors

- All interests in covered autos – indicates whether the selected policy covers all interests for covered automobiles

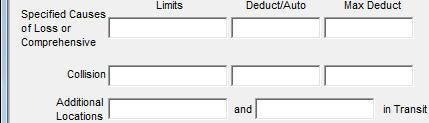

- In the

Specified Causes of Loss or Comprehensive row, enter the following information

about the comprehensive coverage for each automobile in the garage.

- Limits – monetary limit for comprehensive coverage

- Deduct/Auto – deductible amount for comprehensive coverage on each automobile

- Max Deduct – maximum aggregate deductible amount

- In the Collision row, enter the limit, deductible, and maximum deductible amounts for collision coverage.

- In the Additional Locations box, enter the monetary limits amount for additional locations coverage.

- In the in Transit box located to the right of the Additional Locations box, enter the monetary limits amount for in transit coverage.

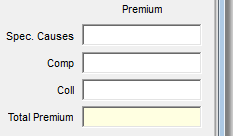

- In the

Premium pane, enter the total monetary premium amount for the following

coverages in the appropriate box.

- Spec. Causes – special causes

- Comp – comprehensive

- Coll – collision