In this topic, we continue our discussion about creating a new submission using the New Submission command located on the Submission Menu.

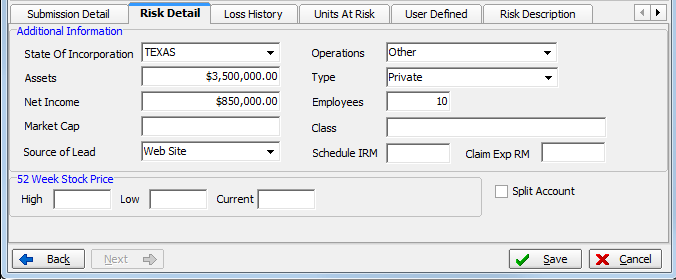

Use the Risk Detail tab to provide additional information about the risk such as assets, income, number of employees, and stock prices for the insured.

- In the

Additional Information pane, using the boxes provided, enter any information

that may be relevant when quoting the risk.

- State Of Incorporation – state in which the insured is incorporated

- Operations – not for general use (Contact your AIM account manager for assistance.)

- Assets – insured's financial assets

- Type – type of entity

- Public – publicly traded

- Private – privately owned

- Net Income – insured's annual net income

- Employees – number of employees

- Market Cap – insured's market capitol

- Class – not for general use (Contact your AIM account manager for assistance.)

- Source of Lead – source that led to the quoting of the risk

- Schedule IRM – schedule rating factor

- Claim Exp RM – claim experience rating factor

- If the

insured is a publicly traded entity, you can enter information about stock

performance over a 52 week period using the boxes provided in the 52 Week

Stock Price pane.

- High – highest stock price over a 52 week period

- Low – lowest stock price over a 52 week period

- Current – stock price at the time of quote

|

The Split Account option is not for general use. Please contact your account manager for assistance. |