In this topic, we continue our discussion of submitting or editing a quote using the Quote command on the Submission Menu.

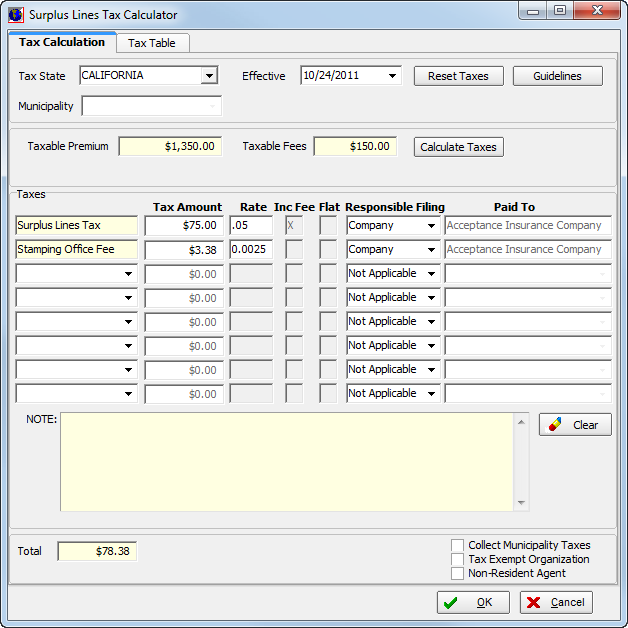

You can use the Surplus Lines Tax Calculator to calculate taxes based on the tax state, premium, and taxable fees.

In the table below, we show you each of the buttons on the Tax Calculation tab and discuss their purpose.

|

Button |

Function |

|---|---|

|

|

Reset the current tax values to the default tax rates for the selected state. |

|

|

Review tax guidelines that may be entered into Data Maintenance Utility (DMU) for the selected state. |

|

|

Recalculate taxes if changes are made or if additional taxes or fees are added. |

|

|

Remove any values that have been entered. |

In the steps below, we show you how to enter surplus lines taxes. You can modify our steps as needed with your own submissions.

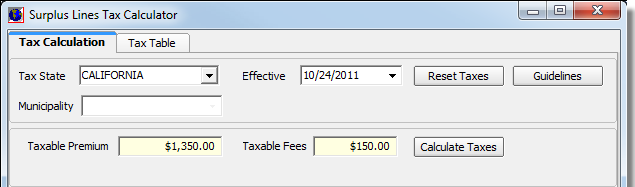

- Enter

the following information on the Tax Calculation tab.

- Tax State – state of the risk's physical address for which taxes are to be calculated (populated automatically)

- Effective – effective date of tax rates

- Municipality – taxing municipality of the risk

- Taxable Premium – amount of premium subject to taxes

- Taxable Fees – amount of fees subject to taxes

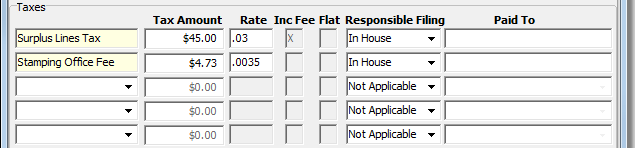

- In the Taxes pane, enter the following information about the taxes that apply

to the submission.

- Unlabeled box – tax or fee description

(Click

to select from the list.)

to select from the list.) - Tax Amount – dollar amount of tax calculated

- Rate – tax rate

- Inc Fee – indicates whether fees are included in the tax calculation

- Flat – indicates whether taxes are a flat amount or a rate

- Responsible Filing – party responsible for filing and paying taxes

- Paid To – party to whom taxes are paid

- Unlabeled box – tax or fee description

(Click

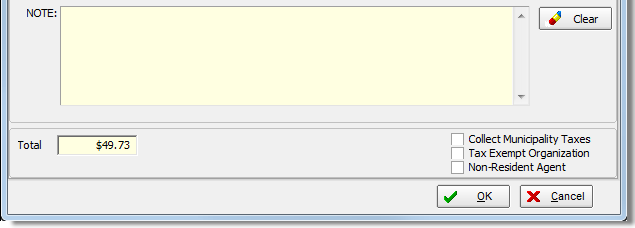

Notes for taxes or fees appear in the Note text box. Notes are read only and cannot be edited.

- Select

any of the following that apply to the submission:

- Collect Municipality Taxes – indicates that municipality taxes are collected

- Tax Exempt Organization – remove taxes from the submission

- Non-Resident Agent – applies non-resident tax rates to the submission, if applicable

- The total amount of taxes and fees are displayed in the Total box.

You can review taxes by state on the Tax Table tab.

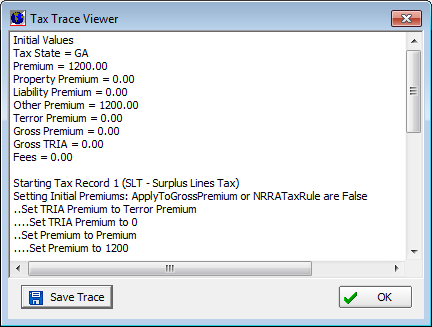

You can view a trace of the quoted taxes. To view the tax trace:

- Right-click the grey area in the Surplus Lines Tax Calculator dialog box.

- Click View Tax Calculation.

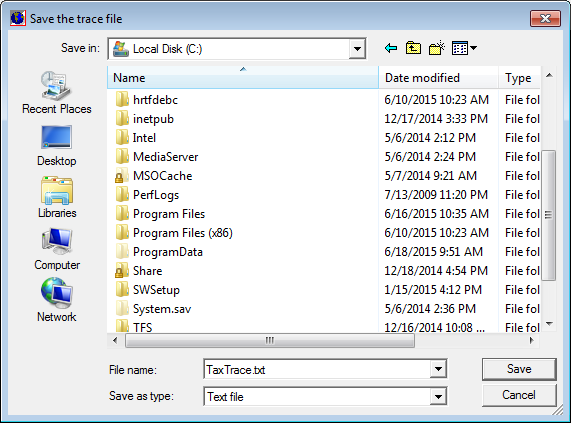

- Click Save Trace to save the trace as a text file.

- To save the file, browse to the desired location, and then click Save.

We continue our discussion of the surplus lines tax calculator in Tax Table.