Create a Home Quote

In the steps that follow, we will show you how to create a home quote in PL Rating. You can modify our steps as needed to perform home quotes on your own.

The information required for a home quote as well as the types of homeowner policies that can be written in PL Rating vary by state.

|

For a video about this feature, click here. |

Before we begin, let's review some of the homeowner coverage forms that you will be dealing with.

| Form | Description |

|---|---|

| HO2 | Broad form/ this policy is a named-perils policy that specifically covers perils enumerated in the policy and no others. Perils usually covered include windstorm, lightening or hail, and fire or explosion. Any peril not listed is excluded. |

| HO3 | Special form/most common type of home policy. An open perils policy that covers any direct damage to the house or the other structures on the property unless it is specifically excluded. |

| HO4 | Contents broad form/ renters policy that only covers personal property, within the rented dwelling and outside along with liability insurance for damages to the property or injuries to other people. |

| HO5 | Comprehensive form/ an open perils policy that also included direct damage or loss to personal property. Less restrictive for named perils coverage than HO2 and HO3. |

| HO6 | Unit owners form / this is a modified HO2 policy specifically designed for owners of condominiums or cooperatives. A condominium/cooperative consist of 2 components: 1) the building and common areas and 2) property specific to each unit owner. The named perils in this form covers certain semi-permanent structures such as carpeting, wallpaper, built-in appliances and kitchen cabinets but does not cover the structure itself. |

| HO8 | Modified coverage form/ policy is for older homes that have a replacement cost that is much higher than its market value. This form provides functional replacement which is cheaper than actual replacement. For instance, plaster walls may be replaced with drywall. |

- On the Clients page of PL Rating, select the appropriate client, or create a new client if applicable.

- On the Quote Selection page, click New Home Quote.

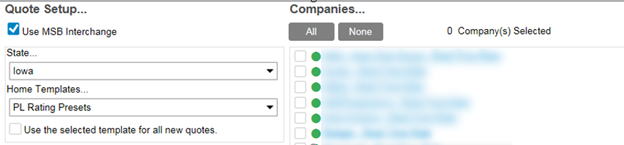

In the steps below we show you how to setup a new quote, select home quote templates, companies, and company groups.

- If you are using the MSB Interchange select Use MSB Interchange.

- Select the state to which the quote applies.

- Select the quote template from the Home quote templates list.

- Select Use the selected quote template for all new quotes option if you want to use your Home quote template selection as the quote template for new quotes.

- In the Companies pane, select the companies to whom you will submit the quote. Alternatively, you can select a group of companies from the Company Groups pane. Selecting All Real Time Carriers selects all available real time carries (shown in blue text) in the Companies pane.

- Click Next.

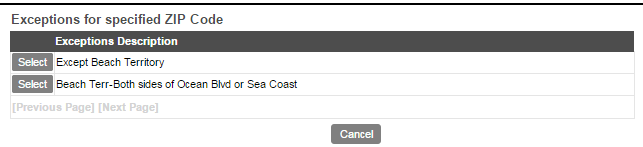

If the zip code is a split area you will be prompted to select the territory or protection class.

- Select the appropriate description to proceed.

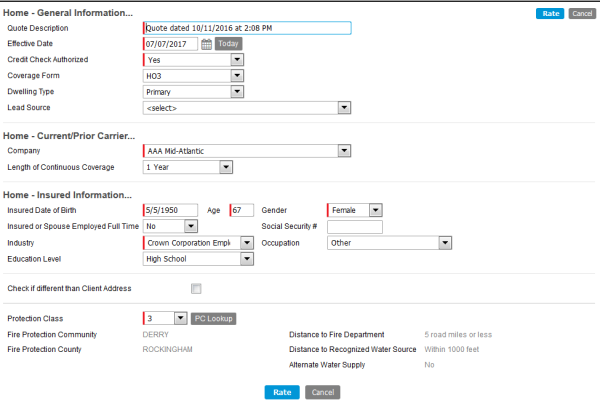

The General Info page, is where you provide general information about the quote, the current/prior carrier, and information about the insured.

All fields with a red bar to the left of the field are mandatory.

Click the image to change its size.

- In the General Information pane, provide the following information:

- Quote Description – brief description of the quote

- Effective Date – effective date of the quote

- Credit Check Authorized – indicates whether the insured has authorized a credit check

- Coverage Form – applicable homeowner coverage form (H03 - H08)

- Dwelling Type – select from Primary, Secondary, or Seasonal

- In the Home - Current/Prior Carrier pane, select the current or prior carrier of the insured's homeowner policy.

- Select the Length of Continuous Coverage from the list.

- In the Home - Insured Information pane, enter or verify the following information:

- Insured Date of Birth

- Age

- Gender

- Insured or Spouse Employed Full Time

- Social Security #

- Industry

- Occupation

- Education Level

- Different than Client Address – enter the address if it differs from the client address

- Protection Class (PC)

- Protected Suburban

- Fire Station PC

- Click Next.

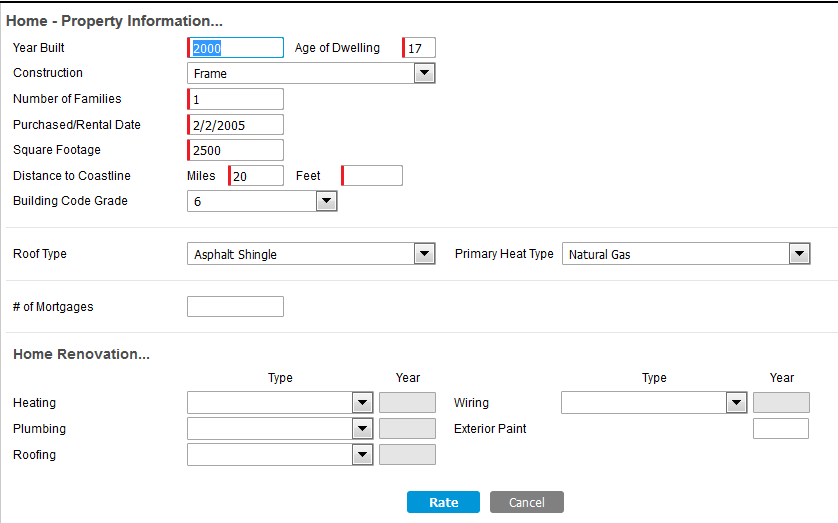

On the Property Info page, provide information specific to the quoted property.

- In the Home - Property Information pane, enter the following information:

- Year Built

- Age of Dwelling

- Construction

- Number of Families

- Purchased/Rental Date

- Square Footage

- Distance to Coastline (in miles and feet)

- # of Mortgages

- Roof Type

- Primary Heat Type

- In the Home Renovation pane, enter information regarding type and year of renovations to the quoted property for the following:

- Heating

- Plumbing

- Roofing

- Wiring

- Exterior Paint

Most of the information in the Home Renovation pane applies to homes over 25 years old.

- Click Next.

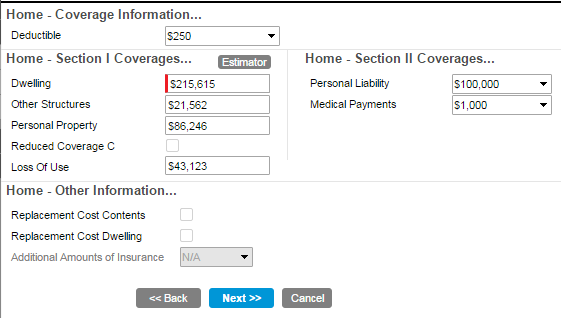

On the Coverage Info page you must provide information about the coverage being quoted.

- In the Home - Coverage Information pane, select the Deductible amount.

- In the Home - Section I Coverage pane, enter the following coverage amounts if applicable:

- Dwelling

- Other Structures

- Personal Property

- Loss of Use

- In the Home - Section II Coverages pane, select the applicable coverage amounts:

- Personal Liability

- Medical Payments

- In the Home - Other Information pane, select the appropriate coverage options if applicable.

- Replacement Cost Contents

- Replacement Cost Dwelling

- Additional Amounts of Insurance

- Click Next.

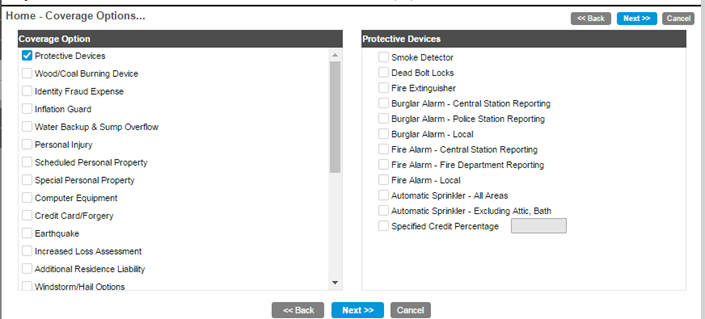

Some primary coverage options, when selected, offer additional selection options or require information be provided.

- In the Coverage Options pane, select the appropriate coverages from the list below, and then enter or select the appropriate information regarding that coverage on the right. Only primary coverages are listed here:

- Protective Device (required by most carriers)

- Wood/Coal Burning Device

- Identity Fraud Expense

- Inflation Guard

- Water Backup & Sump Overflow

- Personal Injury

- Scheduled Personal Property

- Special Personal Property

- Computer Equipment

- Credit Card/Forgery

- Earthquake

- Increased Loss Assessment

- Additional Residence Liability

- Windstorm/Hail Options

- Watercraft Liability

- Permitted Incidental Occupancies

- Increased Special Limits

- Town/Row House

- Residence Rental Theft

- Other Structures Rented to Others

- Oridinance or Law

- Fire Department Service Charge

- Sinkhole Collapse

- Business Pursuits

- Additional Workers' Compensation

- Business Property

- Click Next.

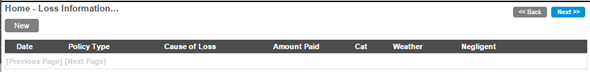

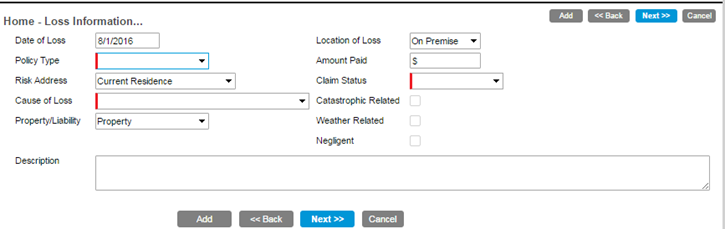

- If prompted, click the New button to enter loss information.

- In the Home - Loss Information pane, enter or select the appropriate information if applicable. Fields available vary based on the Policy Type and Cause of Loss. If there is no applicable loss information, click Next.

- Date of Loss (Note: You must enter the Date of Loss to enter additional information)

- Policy Type

- Risk Address

- Cause of Loss

- Property Liability

- Location of Loss

- Amount Paid

- Claim Status

- Catastrophic Related

- Weather Related

- Negligent

- Click Next.

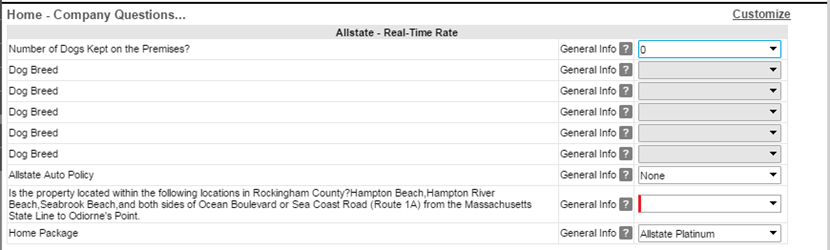

- On the Company Questions page, answer any questions displayed to ensure an accurate rate. Some fields are required and must be completed to continue.

- Click Rate.

On the Rating Complete page you can view carrier messages, premiums, proposal details, and applicable forms from the carrier. A flood proposal may also appear from the carrier.