In this topic, we continue our discussion of submitting or editing a quote using the Quote command on the Submission Menu.

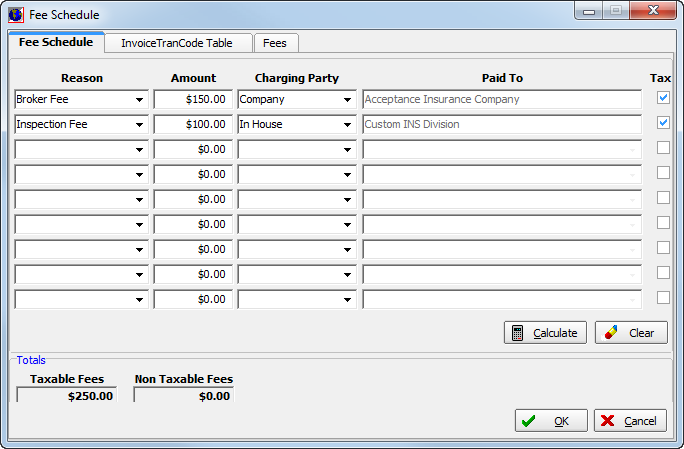

In Fee Schedule, you can enter any taxable or non-taxable fees associated with the quote. In the steps that follow, we show you how to add fees to a submission using Fee Schedule. Later, you can modify our steps to enter fees on your submissions when applicable.

- On the

Fee Schedule tab, enter the following information in the columns.

- Reason – fee reason or description

- Amount – fee amount

- Charging Party – charging party (populated automatically with default part for the selected fee)

- Paid To – party to be paid (populated automatically based on the selected charging party)

- Tax – indicates whether the fee is subject to taxation

|

Fee reason codes and default settings for fees are managed in the Lookup Codes table of Data Maintenance Utility (DMU). Please consult with your AIM system administrator if changes to fees or associated default settings are required. |

- Click Calculate to recalculate and refresh the amounts shown in the Taxable and Non Taxable Fee boxes in the Totals pane.

- Click Clear to clear all entries on the Fee Schedule tab.

- Click OK to save your changes and close Fee Schedule, or click Cancel to abandon your changes.

If you have state fees configured in DMU, the behavior of the Fee Schedule dialog box is changed based on the configuration of the state fees.

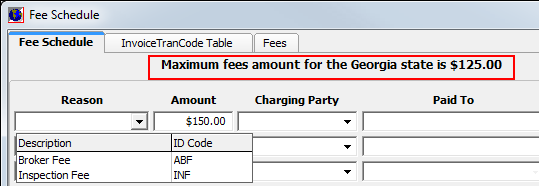

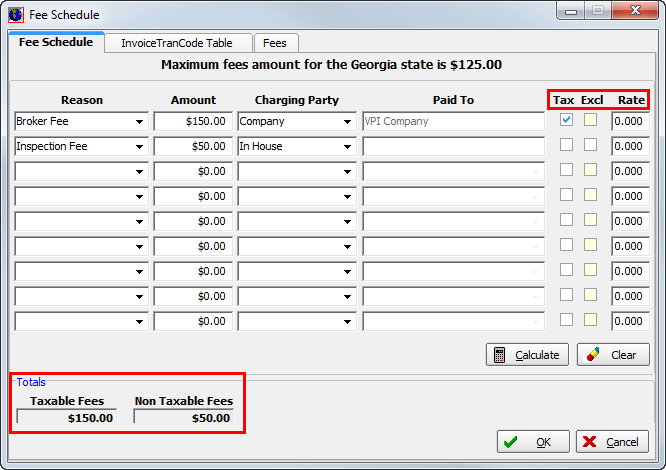

If a maximum fee amount has been established in DMU, then a message appears on the Fee Schedule tab indicating the maximum fee amount.

Fees shown in the Reason list are filtered based on the filing state's fees. If the selected filing state does not have any state fees configured in DMU, then all active fees in your AIM system are listed in the Reason list.

Once a reason has been selected from the list, it cannot be selected again.

The Tax and Excl boxes are used to indicate whether the fee is taxable and/or if the fee is excluded from the maximum fee amount. If the Taxable option is selected for the state fee in DMU, the Tax option is selected automatically in Fee Schedule. If the Taxable option is not selected in DMU, you can select the Tax option in Fee Schedule.

If the Excluded From Max Fee option is selected in DMU for the state fee, the Excl option in Fee Schedule is selected automatically. If the Exclude From Max Fee option is not selected in DMU, the Excl option becomes read-only and cannot be selected.

The Taxable Fees and Non Taxable Fees options, located in the Totals pane at the bottom of the dialog box, reflect the total taxable and non-taxable fee amounts.

If the fee is a percentage based fee, the Rate column is displayed.

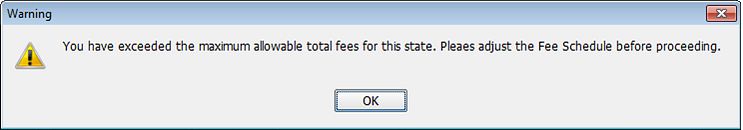

If a maximum state fee has been established in DMU, and if you exceed the maximum fee, the user defined warning message appears. If the warning appears, you can click OK, and then amend the fee schedule to adjust the fees.

|

For more information regarding configuring state fees, refer to the DMU Help file. |

We continue our discussion of the Fee Schedule dialog box in the following topics.