In this topic, we continue our discussion of managing garage coverage on the Garage tab in Units At Risk.

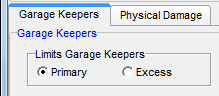

Using the Garage Keepers tab, you can provide specific information about coverage for vehicles are not owner by the owner of the garage. You can specify whether this is the primary policy, and enter limit, deductible, and premium amounts for the policy.

- In the Limits Garage Keepers pane, select the appropriate option to describe the type of policy.

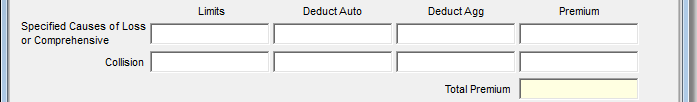

- In the

Specified Causes of Loss or Comprehensive row, enter the following information

about the comprehensive coverage for each automobile in the garage.

- Limits – monetary limit for comprehensive coverage

- Deduct Auto – deductible amount for comprehensive coverage on each automobile

- Deduct Agg – maximum aggregate deductible amount for comprehensive coverage

- Premium – monetary premium for comprehensive coverage

- In appropriate boxes on the Collision row, enter the Limits, Deduct Auto, Deduct Agg, and Premium amounts for collision coverage.

- Verify

that the amount shown in the Total Premium box is correct.

This amount is calculated automatically based on the premium amounts that you have entered.

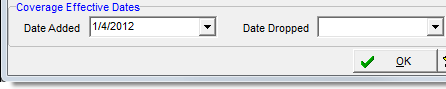

- In the

Coverage Effective Dates pane, enter the coverage effective dates, or click

to use the Calendar.

to use the Calendar.- Date Added – date on which the property was added to the policy

- Date Dropped – date on which the property was dropped from the policy