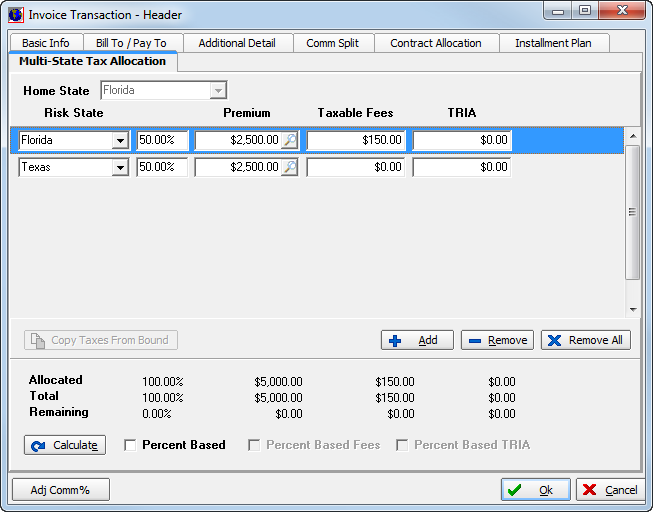

Multi-State Tax Allocation

In this topic, we continue our discussion of the Invoice command, located on the Policy Menu.

If you selected the NRRA Multi-State option when creating the submission (see New Submission), and if the state's rule is configured in Data Maintenance Utility, (DMU) for Home State or Inter-State, as described in the Multi-State Taxes NRRA workflow, the Multi-State Tax Allocation tab will be displayed in Invoice Transaction – Header. The home state and interstate rules allow reallocation without changing tax the amounts applied to the binder.

Consult your AIM system administrator to change state rules in DMU.

You can use this tab to edit the allocation for a particular invoice for reporting purposes. If the invoice has been exported from the Surplus Lines Stamping Office of Texas (SLSOT) module, then this tab is disabled.