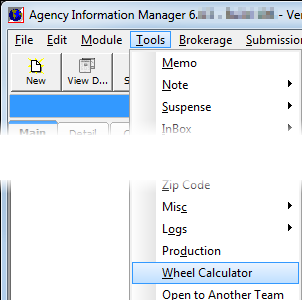

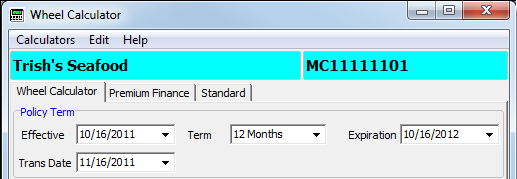

The Wheel Calculator command is used to access the various AIM calculators. AIM comes equipped with three different types of calculators:

- Wheel

- Premium Finance

- Standard

- On the Tools menu, click Wheel Calculator.

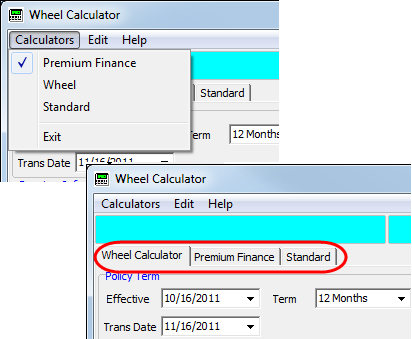

You can move between the available calculators using the tabs or by selecting the appropriate option from the Calculators menu.

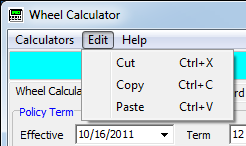

Commands located on the Edit menu can be used to cut, copy, and paste data. As an alternative, you can also use the traditional Windows hot keys:

- Cut – Ctrl+X

- Copy – Ctrl+C

- Paste – Ctrl V

|

The Help menu is currently under development. |

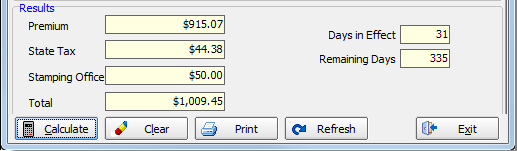

In the table below, we show the buttons available on the Wheel Calculator tab and explains their function.

| Button | Function |

|---|---|

|

Calculates results based on user defined data |

|

Clears user defined data, resetting the calculator |

|

Sends the calculated data to a printer attached to the workstation |

|

Refreshes the displayed data |

|

Closes Wheel Calculator |

Next, we show you how to use the wheel calculator to calculate premiums, state taxes, and stamping fees for a submission based on data that you provide.

- Select a submission record on the Main tab. Data from the submission record will be populated to the calculator for your convenience.

- The Effective, Term, and Expiration dates are populated automatically based on the selected submission record; however, you can click

to change any of these values for calculation purposes.

to change any of these values for calculation purposes. - In the Trans Date box, type the transaction date, that is, the effective date of the transaction to be calculated. If you prefer, you can click

to use the Calendar.

to use the Calendar.

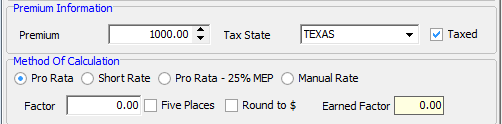

- In the Premium Information pane, the following information is entered automatically based on the selected submission.

You may change the values as needed.- Premium – premium amount to be calculated; the premium amount from the submission is populated automatically

- Tax State – the tax state from the submission; selected automatically

- Taxed – indicates whether the selected submission is taxed; selected automatically based on the submission

- In the Method of Calculation pane, select the appropriate calculation method.

- In the Method of Calculation pane, select the rounding method to be used for the Factor and Earned Factor.

By default, the Factor and Earned Factor will show three digits after the decimal when calculated.- Five Places – returns five digits following the decimal

- Round to $ – rounds the Factor and Earned Factor to the nearest dollar

- Click Calculate.

The premium, state tax, and stamping fee calculations are shown in the Results pane.